Estate planning for physicians is a tricky subject to navigate. You probably spent the better part of at least ten years of your life sharply focused on one thing: becoming a physician and everything else becomes subsidiary.

While the process of becoming a physician may be fraught with stress and focus, the effort results in a pretty great long-term career.

Because you are a medical professional, you are likely very good at math and science and have worked hard to learn how to administer the highest levels of patient care. This requires patience, compassion, and a keen sense of intuition.

You have likely also developed a healthy dose of business sense as well, given the necessary and unavoidable relationship that all physicians must have in order to navigate the world of managed care.

But, along the way, what is not taught in school or as part of clinical training is financial planning. That’s understandable but unfortunate. When you are learning about how the body works, getting a crash course on how to manage your money is not at the top of the list (even though we wish it was!).

The irony is that while there is an impression that all physicians are rich, you know all too well that after you factor in paying back those student loans plus expenses to start up or buy into private practice, early career physicians really don’t have that much money available for which to plan.

An added challenge for physicians is that you are probably all too familiar with the concept of litigation, thanks to the constant threat of malpractice lawsuits. Take that risk and multiply it by your student loan debt – which averages $192,000 (our clients have an average of $300,000) and having a minute to stop and think about whether you even have any assets to offset that staggering debt probably hasn’t crossed your mind.

Physicians are exposed to a much higher level of liability than most people in other professions. It is estimated that more than one in three physicians has had a medical malpractice lawsuit filed against them at some point in their careers, according to the American Medical Association.

Even though the vast majority of these lawsuits do not come to fruition, lawsuits are expensive and time-consuming.

Even when frivolous or unfounded, malpractice lawsuits can wreak havoc on your life and career.

Why estate planning matters for physicians?

Death comes to us all, and no one knows that better than a physician. Despite knowing that the inevitable is part of the natural order of things, the reality of death is a difficult thing to face. More than simply a physical process, death is also an emotional one. What most people don’t realize is that there is also an important financial component to death as well. So, on that somber note, here are a few things physicians need to know about the estate planning process.

Estate planning can be hard for anyone, but estate planning for physicians is especially delicate given the high student loan amounts that most physicians tend to carry through medical school and beyond.

A comprehensive legal plan to protect your earnings, your business, your assets, and your career will help you sleep better at night in the long run. When done right, estate planning for physicians will also work in tandem with your financial plan to pay down your student loan debt over time.

Having a solid plan for your estate will provide peace of mind. Even better, an estate plan will help ensure that your hard-earned assets (and you do have assets, despite the student loan debt) are protected throughout your life and career.

In addition to the ever-present reality of malpractice lawsuits, physicians also have complex business needs if they own a private practice, and those business needs add a layer of complexity to protecting your assets in terms of your estate.

And while many physicians are never what most people would consider rich, physicians do earn a high net income, despite not necessarily having a high net worth. Estate planning can help doctors in any specialty plan strategically so you maximize your earnings despite having high amounts of debt.

Estate planning for physicians is especially crucial because of the number of physicians – slightly more than half – who own their own practices. Adding a business of any size to one’s estate can be a game changer in terms of assets and liabilities.

Ensuring that your finances and personal wishes are in order prior to death will help ensure that your business partners, patients, and loved ones alike are not put in an unexpected financial bind should the unexpected happen.

What is an estate?

Talking about an “estate” may sound like we’re discussing a large mansion on beautifully manicured grounds. Instead, in legal terms, an estate is simply the balance between assets (things you own that have value) and your liabilities (what you owe).

Assets include:

- Cash, including money in savings and checking accounts

- Investment accounts

- Property (both primary home and any rental properties you may have)

- Businesses, including shares in any business you may own jointly

Liabilities include any kind of debt, including:

- Credit card debt

- Student loans

- Mortgage loans

- Car loans

To determine your net worth, subtract the total of your liabilities from the total of your assets. Hopefully, the resulting number puts you in the black, but if not, do not worry. Many people, especially those with large amounts of debt, owe more than they have. This does not mean that you don’t need a will or any kind of estate planning. In fact, it means just the opposite.

Because student loan debt may linger, even after you die.

Any loans borrowed by the federal government will be automatically canceled should you die, but any private loans will remain. That, and any other debt you have, will be passed on to your heir(s) for them to deal with.

Elements of an estate plan

Planning your estate involves creating a set of legal documents detailing your express wishes for what will happen to your assets and liabilities. If you don’t make these decisions while you are alive, someone else will, and that someone will be the state in which you live. Any assets or liabilities not outlined in a will or other documents will enter what is called probate, where the state decides what happens next, and who gets what.

While everyone’s situation will be a little different, these are the documents most commonly needed to plan one’s estate:

- Will: This will allow you to direct where you want not only your assets of legal value to go, but any personal or sentimental items as well

- Power of attorney

- Health care proxy

- Trusts

- DNR order: If applicable

- List of bank accounts, including account numbers and balances

- Investment account information, including account numbers and balances

- Mortgage documents

- Business ownership documents, if applicable

- Past 3 tax returns

- Loan documents: student, car

- Vital documents: married or divorce certificates for you, if applicable, plus birth certificates for any children; include documents for any foster or stepchildren or any applicable adoption paperwork

As you can see, a review of all of this paperwork requires a professional who knows the legalities of each item on this list. It is best to start with an attorney specializing in estate planning. That person will likely refer you to an accountant, financial adviser, or other professionals as well.

Try not to be too daunted. The biggest lift is in gathering the initial paperwork. Once you have that together, the professionals do the work. Should your situation change over time, and it will, you will only need to update the file you have already created.

What happens if you die without an estate plan?

To plan an estate is a fancy way of saying that you took legal steps to make decisions about the dispersing of your assets and liabilities after you die. You will need a set of legal documents to make sure that everything is taken care of in the way you choose.

It’s not enough to simply leave a property to someone, or tell a friend or loved one they can have your home or the money in your bank account when you die. Verbal conversations are generally not binding or enforceable, and what is in writing matters.

Imagine being the partner in a medical practice, and your business partner passes away without a will or estate plan. Your partner’s share of the business will not automatically pass to you. There will be a lengthy process where the state in which the business is owned will try to find legal heirs, who are typically living relatives. Those relatives may or may not want to be found, and may or may not want any part of your business. Maybe they’ll sell you their share or maybe they’ll try to step in and run the business without experience.

In any of these scenarios, you’ll be left at the mercy of probate court and a lot of legal red tape. This will cost you time, will likely cost you money, and could cost you the business.

Now, look at it from your own perspective. You have the ability to not be the person leaving others in the lurch. Your planning now will ensure that the business you worked hard for will thrive after you are gone in the manner in which you direct.

This all rings true for home ownership, as well. Most of us own homes that come with mortgages. It is rare for a home to be owned outright, especially when medical school has to be paid for. And when you die, a house does not necessarily automatically transfer to other occupants of the house.

If you die, and you will, something will happen to your stuff one way or another.

Either you decide who gets what, or the state will decide for you. This could be costly and time consuming for your heirs. This could also mean your hard work to curate your personal and professional life could end up at the mercy of state legal representatives.

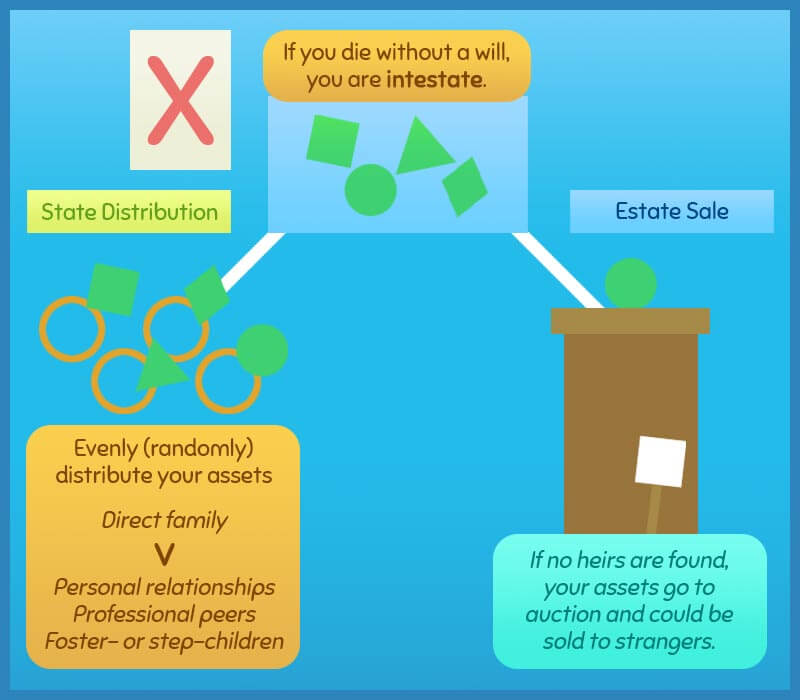

Dying without a will has a legal term: intestate. If you die intestate, your assets (and debt) will be distributed evenly amongst your heirs. You may think that your heirs are obvious or even that you don’t have any heirs, but part of the state’s responsibility in taking over your estate is to identify your heirs.

They could be your surviving spouse, your siblings, your children, and even possibly aunts, uncles, or cousins. The state could also decide that, in the absence of any of these more obvious relatives, your heirs are relatives you’ve never even heard of. The state generally looks for relatives by blood or marriage, and goes down the line until they find someone, skipping over anyone who may have been close to you in a personal relationship but not in legality, such as foster children or stepchildren.

If no heirs are found, the entire estate goes to the state to auction off as they see fit.

Dying without a Will

The technical term for dying without a will in place is intestate (keep reading to learn more about other terms in estate planning).

When you die intestate your assets and debt will be distributed evenly among your heirs. In your mind, you picture your heirs as the closest people to you, perhaps your spouse and children.

It could be that you don’t have anyone that you would consider an heir.

That is where the state comes in. It’s the state’s responsibility to take over your estate and identify who will take your assets.

What if you don’t identify any heirs?

The state will sell off everything that can be sold. Check out the local newspaper. You will likely see items in the classified listed as “estate sales.” You may also see these advertised on Craigslist or in your community in other ways. These sales are generally happening for 2 reasons:

- The state is auctioning off or selling everything they can from an estate with no known heirs

- A family member inherited things they don’t want or need to afford to maintain and so are selling what they can to liquidate assets.

Estate sales are not necessarily a bad thing. If you inherit a home but would like to move in all of your own furniture or sell them home, you need to do something with the contents of the home. There are likely many items that will be useful to others, so it makes sense to sell them in this way.

So, who have you identified as your heirs?

Unless you have specifically identified them the state will do it for you. Heirs might be a surviving spouse, your children or your siblings. Your aunts, uncles or cousins could also be considered heirs.

In the absence of any obvious relatives, the state may skip over someone who you have a close personal relationship with. Unfortunately, that could include any foster children or stepchildren that you might want to inherit.

That’s why it’s so important to have a will.

What is an Advance Care Directive?

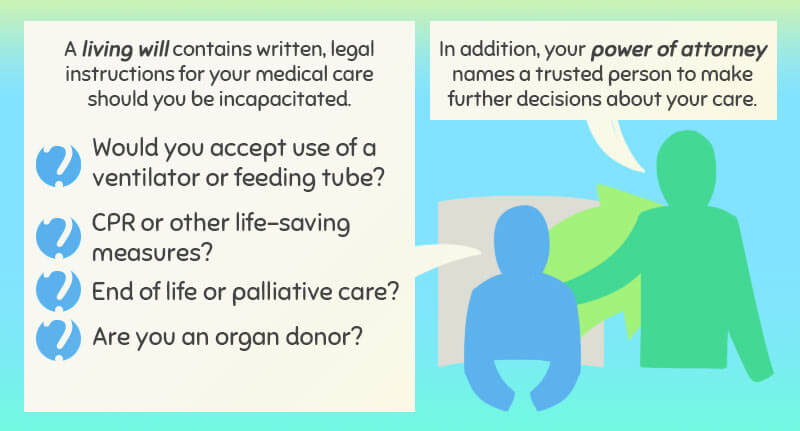

Advance care planning is necessary for every adult. It is a way for you to express your values regarding medical care and your health before a serious medical event happens.

At any time you could suffer a medical crisis there is a possibility that it will take away your ability to make healthcare decisions. In that event, would you want the medical team to use a ventilator to support your breathing? Are you interested in the possibility of a feeding tube? Just how far do you want the medical team to go in their attempts to save you?

There are also numerous things to think about when you think about your end of life care. You’ll need to decide how you want your physical, mental and spiritual needs to be handled. Many of these decisions will vary depending on your values and culture.

There are four steps when handling your Advance Care Directive:

- Finding out which decisions do you might need to make.

- Decide how you want those various medical scenarios handled.

- Put your decisions into an Advance Care Directive.

- Let your doctor and family know your wishes.

Who do you trust to make decisions for you? The Advance Care Directive is a tool for you to put your directions and another person that you trust in charge before the advent of disease, life-threatening injury or end of life care is needed.

How does a living trust help you?

Having a will is not enough in the event of death.

You’ve taken steps to ensure that your affairs are in order if you die. It ensures that you control what happens to your property and who your heirs are.

But what happens if you become incapacitated?

How do you feel about the medical team taking heroic measures with you? What does the medical team consider heroic measures to be? Do you want to be put on life support or donate your organs?

Does anyone know how you feel regarding these things?

A living trust allows you to designate someone to make decisions regarding your medical well-being and financial assets in the event that you need long-term, managed care. It’s a legal document that is created while you are still able-bodied.

Who is the designated person to make these important decisions? That person is the executor, whose role is to make sure your instructions are carried out.

There is a difference between a revocable trust (allows you to change your mind) and an irrevocable trust it will (stays in place after your death).

The document can be notarized, but a safer option is to have a lawyer draft the document.

Whether it’s revocable or irrevocable, having the document means that you are protecting yourself from the unimaginable.

As a healer, it’s hard to think about becoming incapacitated. However, just like your patients need a legal trust for their peace of mind, so do you!

The best peace of mind comes from making living trust decisions with the help of expert legal advice.

Challenges of estate planning for physicians

As with most things in life, estate planning is a challenge due to two unavoidable factors: time and money.

Time

Time is perhaps the most precious commodity for all of us, but especially when you are a physician. You know all too well that your job is about much more than seeing patients and writing notes on their charts. You have insurance paperwork to file, appointments that run long due to unforeseen complications, and on-call hours to fulfill.

This is after, of course, the years of long days and sleepless nights that you put into training to get to where you can finally earn a salary as a physician.

You also have planned on how to manage your student loan debt to deal with, and that takes time as well.

You barely have enough hours in the day to deal with patient care plus the business plus insurance companies plus additional training plus attending and speaking at conferences plus writing papers and publishing in your field. A physician’s job is long and intense.

And, you likely have a life to live amidst all of this. If you have a partner or spouse, or minor children, those relationships tug on your time. Add in supporting parents, friendships, and the all-important and oft-overlooked self-care, and what time is left in the day?

Adding in one more challenge, to plan for something that is likely a long way off and does not affect your current lifestyle is likely not a priority.

Money

People think that doctors are rich. That’s really not the case. Because of this, it became prohibitive to consider hiring a lawyer because they are very expensive and hiring them takes money in addition to that precious time.

Because you likely don’t have legal expertise or experience as a certified financial planner, drafting a comprehensive and legally binding estate plan is something that will cost you money.

Lawyers are neither free nor cheap, and you will need several hours with one, minimum, to draft your estate plan.

The upside of this is that there are ways to maximize your time with lawyers to save you money in the long run.

Benefits of estate planning for physicians

Despite the need to take some time to gather paperwork and a bit of money to hire an attorney, there are very real benefits of estate planning for physicians in particular.

Peace of mind

Having one’s financial affairs in order is rarely a bad idea. The best part of estate planning for physicians is that you only have to do the heavy lifting once.

Get everything together, have your plan drawn up, and then you have a master document that only needs to be updated every five or ten years, or any time you experience a major life event. You can, in a general sense, set it and forget it.

Ensures your assets are protected

You may have a great idea about who you want in control of your home or business or retirement accounts when you pass away, but your best intentions become meaningless without a written, official, legalized estate plan.

Ensures the people you care about are protected

It’s easy to wave off worrying about what will happen to your estate when you die, because, after all, you won’t be here to worry about it. However, passing away without a plan all but ensures that your heirs and loved ones will be mired in possible debt, taxes, headaches, and legal red tape, potentially for years to come.

Protects against the unexpected

Having a professionally prepared estate plan ensures that your assets won’t become “intestate,” which means that the state in which you reside decides who gets what among your assets.

The state may determine that your heir is your closest living blood relative, who could be a cousin you haven’t seen in twenty years, as opposed to your life partner who resides with you in your home.

Action steps to create your estate plan

If you’re wondering whether or not you need an estate plan, the answer is: you do. Whether or not you own property, or have retirement accounts, or have minor children, even if you’re not sure if you have any assets at all, you most certainly are on a career path that will lead to a higher than average income, even if you don’t get to pocket as much as you might like thanks to student loan debt and business expenses.

While salary varies based on specialty and location, the average physician salary as of 2018 was $299,000. That is a lot of money, make no mistake about it, but as a physician, you know all too well that you are likely very far from being rich thanks to the great expense it takes to earn the prestigious title of medical doctor.

Anyone who has a six-figure income coming in owes it to themselves to know exactly how to maximize that money over time, even after one has passed away.

Be sure to hire a professional for this. Do not simply search on the internet for estate planning for physicians for a template. Those templates exist, but they will not help you make the decisions that are best for you and your family if you have children involved, or if you need tax advice (and you will very likely need tax advice).

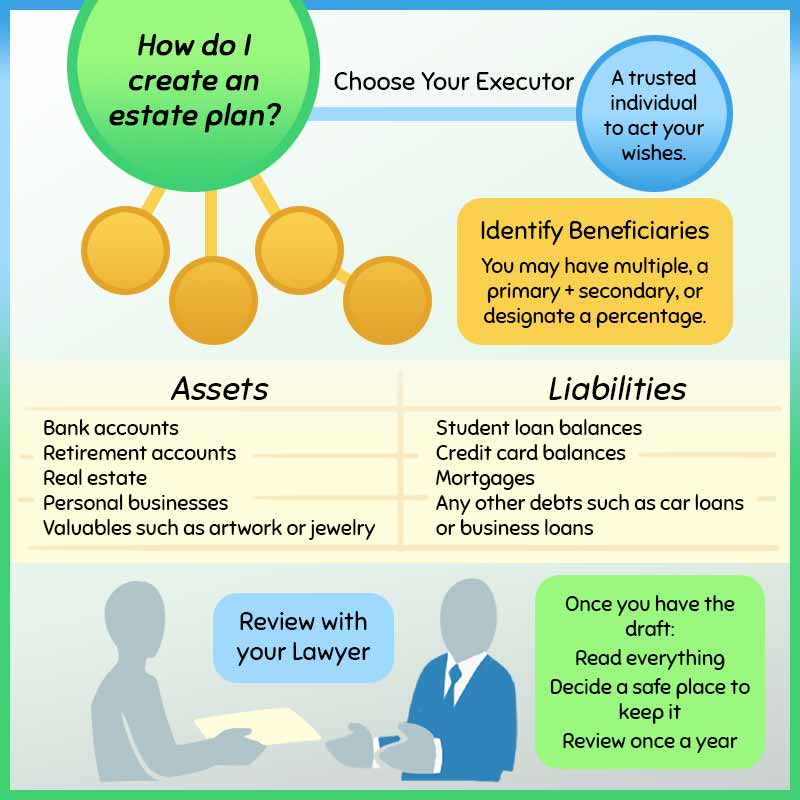

Identify beneficiaries

You may have one or more beneficiaries or designate a percentage split among multiple beneficiaries. You can even designate a primary and a contingent beneficiary. But no matter how you divide up what you have among whom, you need to state, explicitly and in writing, exactly who those beneficiaries are.

Do not expect that anyone, least of all an attorney or judge who doesn’t know you, will make any assumptions based on who lives in your home. Perhaps you wish for some or all of your estate to bypass a blood relative in favor of a friend or other family member. If so, you need to write this down and have your intentions legalized.

Choose an executor

An executor is a personal representative who handles your estate once you are deceased. This person does not need to be an attorney or legal expert of any kind. Your executor can be anyone you wish.

Ideally, you will choose a person who knows you well and whom you trust to put your best interests and personal wishes first. Your executor’s role is to ensure that your expressly stated wishes as legalized in your estate plan are carried out.

Review your net worth

While your attorney will guide you on what documents you need to bring to your appointment, it will save you time if you arrive prepared. Proper estate planning for physicians, or for people in any profession, is essentially an exercise in reviewing your assets and determining what you wish to happen to them should you die.

It makes sense, then, to start by identifying exactly what assets you have. Your assets minus your debts equal net worth. If your assets exceed your debts, congratulations! You will have money left over to go to your heirs.

If your debts exceed your assets, do not worry. This is very common, and a proper estate plan is exactly what you need to ensure that your heirs are not overwhelmed with the burden of your debts after you pass away.

Make a list of your assets

A simple list or basic spreadsheet of your assets is helpful, though if possible, compile statements and other supporting documents as well. Assets are anything of financial value that you own.

Cash, money in your bank accounts, and any retirement accounts count as assets. Any real estate that you own, specifically if you own the property outright or have equity in the property, is an asset. Your business may be an asset, depending on your financials.

Any artwork, valuables, or other collectibles such as cars or jewelry are assets as well. Be sure to include appraisal documents if you have them.

Make a list of your liabilities

Don’t be afraid to face the reality of your debts. By engaging in proper estate planning, you are taking control of what you owe, and taking steps to maximize your finances. Liabilities are, quite simply, your debts. Anything you owe on a credit card is a liability.

Student loan balances are liabilities. Money owed on a mortgage, minus the equity, is a liability. Any other debts you may have, such as a car loan or loan on your business is also a liability.

Hire your attorney

It’s best to hire an attorney who specializes in estate planning, and in particular, estate planning for physicians. This individual will be best prepared to maximize your time in the planning process, which will save you money on legal fees.

It’s not uncommon to meet with attorneys for a consultation to determine if you are a good fit for moving forward. However, it’s important to know that an attorney’s time is rarely, if ever, free. You should expect to pay a fee for the consultation. This fee will vary based on the attorney and will include factors such as their experience and even your location.

Once you are ready to move forward with your attorney, you may pay a flat fee up-front based on the attorney’s estimation of how long it will take to complete the work. More likely, however, you will be asked to pay a retainer. This is akin to paying for the work upfront, based on the estimated number of hours that the attorney expects your work to take. You can expect a detailed monthly statement of time worked on your case, with the hourly rate deducted from the prepaid retainer. If the work takes longer then anticipated, you will be informed of this and will be able to make a decision about how to proceed.

Don’t let the idea of a retainer scare you. Two to three appointments of roughly an hour each are the general ballpark of what you may expect for a consultation, presentation, and review of documents, and review of the finalized plan. This will vary based on your personal situation, of course, but this should give you an idea of what to expect in a general sense.

Or you can skip all of that in person stuff and work with a digital estate planning firm that has a fixed flat fee. This is something both my wife and I have done and were very happy with their service and product. It was a perfect estate plan for our physician family.

After the plan is written and finalized, you won’t need to check in again until you either experience a major life event, such as the birth of a child, the purchase of a property, or payoff of a loan. You may also wish to check in with your attorney once every few years or so to review everything and make sure that your existing plan still reflects your wishes and financial situation.

Once you have an estate plan, then what?

While having the estate plan written is the biggest lift in terms of time and money, it’s important to take a few extra steps to ensure everything is sorted exactly as you wish.

Read everything

Some people make the mistake of thinking that it’s the attorney’s job to read over everything and pay attention to detail.

That is certainly correct, however, attorneys are human just like anyone else, and no one knows your financial situation and your wishes better than you do. Be sure to not only review the completed estate plan, but read it carefully, pen in hand.

Make notes as you go. Write down any questions you have. Don’t think that because the plan is written with legalized language that it’s beyond your expertise to review.

Your estate plan represents your life’s work and your money, and you are the most important person who needs to understand it, not the attorney.

Decide where you want everything to go

Your estate plan will be a document that you need to keep safe. Consider buying a safe to keep in your home to protect against flooding or fire. You might also wish to consider renting a safe deposit box at a nearby bank.

Be discerning about sharing the document or information contained within. Provide a copy to anyone who might need it, such as your executor or the identified guardians of any minor children.

You also could choose to provide a separate letter to those individuals outlining details of their part only. This will allow you to share the information they need to have without your divulging all of your financial details.

Review once a year

You don’t necessarily need to schedule an appointment with your attorney on an annual basis. Instead, simply take out the document and read through everything.

Have you experienced any major life changes? Have you changed your mind about any of the details? Do you wish to make any changes to your beneficiaries? It’s always okay to change your mind.

Making minor changes like these over time is much cheaper than overhauling the entire plan after too much time goes by.

That being said, you need to review the highlights every year. In addition to any changes in your beneficiaries, look at who you have identified as the executor and the guardians.

There are some good reasons to make changes. Let’s look at some of them: Has your marital status changed? Did your beneficiary pass away? Did you get married or divorced?

Other reasons you might need to tweak your estate plan are inheriting property, becoming a grandparent or adopting a child.

A major move across state lines may also lead you to update your estate plan. After all, different states have different requirements and laws.

As you can see, reviewing and updating your estate plan can keep your wishes current and your plan legally up to date!

What about life insurance?

A life insurance plan is an important part of estate planning for physicians. This should definitely be part of your conversation with your estate planner.

Life insurance is generally covered by your employer if you work for an organization, such as a hospital. If you own all or part of a private practice be sure not to overlook having adequate life insurance coverage for yourself and potentially for your staff.

Life insurance is especially important if you have minor children or other dependents, or a spouse who relies on your income.

The purpose of life insurance is that your immediate family members can navigate any funeral costs, as well as manage expenses while your estate is in the process of being settled.

As with all parts of estate planning, life insurance lends peace of mind.

What about minor children?

If you have minor children, you need a will. Regardless of any other estate plan you may do to take care of property or financial accounts, ensuring that you have a legally binding plan in place regarding care of your children is crucial.

Decide which responsible adult or adults you wish to be their guardians. Set up a time to speak with those individuals, and ask if they are willing to be named as guardians in your will.

Give them time to digest this information, consider the ramifications of it, and get back to you at a later date with their answer. Be prepared for their answer to be no, and honor that. It helps to identify a few backup individuals to ask should your preference decline.

Once your guardian or guardians have been determined, inform your attorney so that the proper documents can be drawn up to formalize the agreement.

This is in the best interest of your minor children. Should the unexpected happen, your having this plan in place will ensure that your children are cared for in the manner of your choosing, with minimal stress to them.

Your attorney and financial planner can help you determine how your estate can be structured so that there is financial consideration set up to support your minor children in the event of your death. This information should be reassuring to your chosen guardian or guardians.

Do you need to update your guardian?

Choosing a guardian is no easy task.

As a parent, you strive to impart your morals and values to your children. As you consider who you would trust to take over the guardianship of your children you’ll want someone who has similar spiritual and parenting beliefs. You’ll think about who has matching values.

This is not a decision that can be made lightly. It will take time to find the right responsible adult to stand in your stead.

It’s a relief to decide who matches your expectations (as close as possible). This is someone who you imagine would make a great guardian for your children. However, change is inevitable.

Something happens and you see how the appointed person reacts to adversity or who they really are. It might be that they really are a good match, but their personal circumstances change and taking on guardianship of a child (or children) would be too much of a burden.

These situations will cause you to rethink the decision you made.

Your choices are not irreversible. If you are no longer comfortable with your pick, you are free to make changes as soon as possible.

Your children are your first priority. That means choosing someone who shares your values or whose circumstances allow them to take on additional responsibility.

The most important thing for everyone involved is keeping guardianship updated.

Pets count, too!

Pets are part of the family and they are technically and morally dependents. They should be considered when you are doing estate planning.

Keeping your children and pets together would be most beneficial in the event of a tragedy. However, there are many times that your family or friends aren’t in a position to care for your animals.

There are pets that live for decades and require extensive or specialized care (reptiles or birds).

It’s responsible pet ownership to include the future of your pets during estate planning. This will ensure that they are cared for in a compassionate manner after your death.

Having honest conversations with the people you choose to be guardians will lead you to create a successful plan for your beloved pets.

What about real estate?

Real estate seems straightforward, but can actually be trickier than you might expect to settle upon your death. Simply living in a house, or even having a rental agreement, is not enough to ensure that a person has the right to remain in the house after your death.

Even if you are married, if your spouse’s name is not on the deed, that person is not automatically legally entitled to remain in or own the home after your death.

Part of your estate planning conversation should include discussion of whether it makes financial sense to retitle the property in both of your names, which carries with it attendant fees to consider, or if it makes more sense for your situation to create a tenancy in common document instead.

A tenancy in common is a legal document that will allow your significant other or person of your choosing to remain in the home after your death, despite not having his or her name on the title.

What about retirement accounts?

A good rule of thumb with estate planning for physicians or for anyone else is to always keep your eye on your retirement accounts. As you move from one organization to another – and anywhere from 40-70% of people will change jobs within five years of starting their first professional position – it can be easy to leave retirement funds in the employer-held accounts.

The money is still yours, after all. It will still likely grow, ebb, and flow along with the stock market, whether it stays in your employer-sponsored funds or into funds you have managed on your own. The downside of leaving the money where it is, though, is that the money is then easy to forget.

You can find yourself years down the road and may have moved and lost track of statements and then your money is not working for you as well as it could.

Every time you leave an employer, take the time to fill out the paperwork to roll your retirement account money into a private account.

Your financial planner can help with this. It’s a very easy process, and then over time, your retirement funds will be managed together in a place where they can grow in accordance with your own financial goals because they are managed by an advisor you have hired to look out for you.

What about taxes?

If there is one truth about life that we know all too well, it’s that taxes never go away. The best path forward is to accept this and plan for it. The upside of paying taxes is that there are plenty of professionals available to help you navigate how to pay them so you maximize using all of your assets.

While it is always best to consult a certified professional accountant for advice on all things tax-related, it helps to know that there are some ways that the law is currently on your side in regards to estate taxes.

While tax law can and does change every year, as of 2017, the federal exemption before estate tax is applied is $5.49 million dollars. That means that as long as the total value of your estate at the time of your death does not exceed $5.49 million, your heirs will not owe any tax on your estate.

This amount doubles if you are married.

What about charity?

Many people like to consider leaving some or all of the proceeds from their estate to one or more charities. If there are any nonprofit organizations that are particularly meaningful to you, it’s not a bad idea to consider leaving them a gift in the form of a lump sum or even an endowment.

As of 2015, you can donate up to $5.43 million during or after your life tax-free. That number doubles if you’re married.

Charities make it easy to accept your generosity. It will cost you nothing to reach out to your favorites now to ask about their planned giving opportunities. They likely have a brochure or website at minimum or a professional who will be happy to speak with you and share the information you will need for planning your estate.

Be sure to consult with a certified public accountant to determine the particulars of your estate plan. This way, you can rest assured that your heirs are not saddled with an unexpected tax bill after your death.

15 Most common questions physicians ask about estate planning

The time to put a plan in place to protect your wealth is now. The plan starts with creating a will, medical directives, and guardianship for minor children and pets. Estate planning for physicians will protect your home, business, and family.

Here is a taste of the fifteen most asked estate planning questions for physicians.

1. What is estate planning?

Do you think estate planning is only for the rich and famous? If that’s what think you would be wrong. Estate planning is about the money and property that someone owns at the time of their death. The process of estate planning for physicians should put your mind at rest.

2. Why have an estate plan?

Estate planning is a way to ensure that your estate and family are taken care of as you direct. It’s your way of controlling what happens to everything your hard work has built. Remember that the assets that you built also mean a tax burden for your survivors. Plan ahead to avert the burden your family has to deal with in the event of your death.

3. How is estate planning for physicians different?

Estate planning for doctors is similar to anyone else. The main difference is that some doctors have private practices. In fact, more than half of physicians owned a practice. Owning a practice and/or other businesses adds additional complications.

4. What should I think about when it comes to estate planning?

You think about who you want to have your special heirlooms or any of your possessions. Is there someone you would like to have a special gift of land or money? This is your last chance to share those things that are special or hard-earned. An attorney and tax advisor will help you create your estate plan and minimize the tax burden.

5. What makes up my estate?

An estate is everything that you own that has value. You can think about your estate in terms of assets–and liabilities.

What comprises your assets?

- Investment accounts

- Property (personal or business)

- Cash (money in savings/checking accounts)

What about your liabilities?

- Debt (credit card, student loans, your mortgage)

The formula for figuring your net worth is below:

- Subtract the total of your liabilities from the total of your assets

Even if you are “in the red” you will need an estate plan. Your heirs may be responsible for some types of debt, such as your private student loans and other debt. If you die the loans you borrowed from the federal government will be canceled.

6. Can I write my estate plan myself?

You are in control of your estate and could write the plan yourself. The problem is your DIY estate plan might not hold up in court, especially if anyone contests it. However, a lawyer will ensure that your wishes are carried out. A lawyer who specializes in estate planning for physicians can navigate the estate planning laws (which tend to change year by year) or put you in contact with other professionals. An attorney will also know how major life changes affect your estate and can adjust the plan accordingly.

7. What makes up a good estate plan versus a bad one?

A good plan ensures that your possessions, property and family are taken care of. It will be handled by a lawyer who has experience with estate planning for physicians. It will include all the various legal documents such as living trusts and medical directives.

8. What is a living trust, and if I have one do I still need a will?

Yes, you still need a will. A will has important functions that a living trust doesn’t have. A living trust is a document created while you are alive that handles designated assets. In the event that you are incapacitated a living trust allows your assets to be available for you until your death.

9. Why have health directives?

Which treatments do you want in the event of an emergency? Which ones would you absolutely refuse? Health directives are legally binding documents that “direct” medical personnel in the event that you can’t tell them yourself. They allow you to get the care that you prefer according to your values.

10. I have a will. Isn’t that enough?

Unfortunately, a will is not enough. Many assets need to be transferred via a living trust. You’ll also need other documents in the event of a health crisis (Power of Attorney, Advanced Medical Directives). These documents need to be in place before they are needed.

11. I am single or in a same-sex relationship. Does that affect my estate planning?

Being married or sharing a home doesn’t ensure that your assets will automatically transfer to your spouse. You must take legal steps for your assets to be transferred to the person (or people) you choose. An estate plan is very important when you want your assets to be granted to a particular beneficiary.

12. What documents do I need for my estate plan?

You’ll need documentation of your assets and liabilities. That will include copies of statements. You also need to bring the legal documents that you already possess. You’ll need mortgage statements and documents for loans. Surprisingly, setting up an estate plan for physicians should only take a few hours.

13. Once I have an estate plan, does it ever need a checkup?

Assets and liabilities may change over time. Life events also change. You may get married, divorced or have a child. That means your plan may need to be changed or updated depending on your individual circumstances. Reviewing your estate plan means you’ll save time and money while you keep your documents current.

14. Who are your heirs and how will they be affected by your estate plan?

You get to choose who your heirs will be. However, if you don’t designate beneficiaries the state will make that decision for you. They may choose based on your blood relationships (and not always who you would have picked). Every asset will need a primary and secondary beneficiary.

15. Should pets be considered in an estate plan?

Your pets may be an intrinsic part of the family. They will require care in the event that anything happens to you. That means your pet (s) should be considered when you are making your estate plans. It’s important to choose an appropriate guardian for your pet.

Important terms you need to know

Here is a glossary of important terms that you may find handy as you work with your attorney and other professionals on planning your estate.

Advanced Care Directive: See “Living Will”

Asset: Something tangible and liquid that has value based on a contractual claim.

Beneficiary: The person (or place) who receives your money or property after you die. You can have multiple beneficiaries. A primary beneficiary is first in line to receive the money you designate. A secondary or contingent beneficiary is the person who will receive the money should the primary beneficiary be unavailable or deceased.

Certified public accountant: A professional financial adviser who has passed a formal and rigorous exam qualifying that individual to provide advice on all matters relating to taxes, including audits, personal taxes, business taxes, and the like.

Endowment: A gift of money or incoming-producing property to a public organization, such as a nonprofit, charity, hospital, or school. The donation is for a specific purpose, such as research or capital improvements, or do generate ongoing income to be used by the organization. The original gift, known as an “endowed asset” is kept intact and generates ongoing income on a long-term basis.

Estate: An estate is the term to represent all property owned by you at the time of your death.

Estate planning: A written plan designed to identify your beneficiaries, ensure your property will be transferred appropriately to those you designate after your death, minimize taxes, determine any long-term care plans you may wish, and determine any funeral arrangements you so choose. An estate plan is particularly helpful in reducing time and money that your survivors must spend to resolve all of your assets and liabilities.

Estate planning for physicians: The same as a general estate plan, though may have the added component of determining resolution for a private practice or other profession-related business as well as navigating high medical school loans.

Estate planning law: The branch of law concerning living wills, trusts, powers of attorney, other documents and planning to protect management of property and minimize taxes after death.

Executor: A legal adult appointed to represent an individual after the time of death, and ensure that the wishes of the deceased and legal obligations for property and possessions are carried out.

Financial planner: A professional financial adviser who provides a written, comprehensive financial plan, along with dispensing financial advice.

Guardian ad litem: A court-appointed adult who stands in for a minor child during legal proceedings when the child is deemed unable to represent him or herself. This is typically, but not restricted to, the attorney or a family member.

Intestate: When you die without a will, and the state takes over the handling of your estate in according to the law, which may not necessarily be in accordance with your personal wishes.

Liability: A legal obligation to deliver payment to fulfill a contractual claim.

Legal guardian: An adult over the age of majority (18 in most states), who is legally responsible for a child’s physical, educational, and financial needs.

Liquid assets: Something of monetary value that can be converted into cash in a short amount of time.

Living will: Sometimes known as an “advanced care directive,” a living is a document that clearly states a person’s wishes for end of life care. The document is only valid until the time of death.

Major life event: Otherwise known as a qualifying life event, these are major events that can lead to changes in financial status or situation, to include loss of health care coverage, getting married, birth or adoption of a child, death in the family, change in residence, change in citizenship status, or getting married or divorced (list is not all inclusive).

Minor child: A child under the age of legal majority, which is 18 in most states.

Net worth: The combination of what you owe and what you own.

Power of Attorney: While the rules differ from state to state, a power of attorney is the legal permission for another person to act on your behalf with concern to legal matters.

Power of Attorney for Asset Management: A form of Power of Attorney limited to areas of financial affairs. This document allows you to nominate an individual to represent you specifically regarding your financial affairs should you become incapacitated.

Power of Attorney for Health Care: A form of Power of Attorney documents that provides solely for appointment of a health-care agent, without specific directives regarding medical treatments.

Probate: A legal process to verify that a will is valid.

Retainer: A fee that a client pays up front to cover the costs of legal fees. This may be a general retainer, which covers a specific period of time as opposed to a specific project, a lump sum fee paid in advance from which the attorney draws funds to cover time spent working on a case, or a special retainer, which is a flat fee paid by the client for a specific project.

Tenancy in Common: A legal agreement where there are multiple owners of a property, each owning a share. These shares can be transferred to one another either during a lifetime or via a will. This agreement allows all parties to have the right to occupy and use the property, regardless of whether or not they are legal owners of the property.

Title: A document that states who has legal ownership of and the right to use a piece of property.

Trust: A legal arrangement where a third party, such as an individual or organization, holds assets on behalf of one or more beneficiaries. There are many types of trusts, including those that can provide liquidity to an estate for the benefit of beneficiaries, or to provide income for a surviving spouse.

So, do you need an estate plan?

Bottom line: you absolutely do. The good news is that creating an estate plan is not that difficult when you employ the right professionals.

The peace of mind you will achieve from knowing that your home, your property, your business, and your life are properly cared for in the event you are incapacitated or should die is more than worth than bit of time and money it takes at the outset to create the right plan for you.