The medical field is one of the highest-paying industries in the nation, and physicians lead the pack. While you can expect to make six figures as a doctor, your specialty and other factors can have a pretty drastic impact on how much you earn.

So who are the highest paid doctors?

In this guide, we’ll unpack the latest research on physician’s salaries to show you what medical specialties have the highest earning potential.

We’ll also look at the highest paid doctors by factors like location and workplace setting.

Top 10 Highest Paid Doctors

Neurosurgeons are the highest paid doctors, earning an average salary of $788,313 per year.

That’s based on Doximity’s 2023 Physician Compensation Report, which surveyed more than 190,000 licensed physicians in the US about their earnings.

The table below shows what the top ten highest paid doctor specialties are, based on Doximity’s survey results:

| Specialty | Income |

| 1. Neurosurgery | $788,313 |

| 2. Thoracic Surgery | $706,755 |

| 3. Orthopedic Surgery | $624,043 |

| 4. Plastic Surgery | $571,373 |

| 5. Vascular Surgery | $557,632 |

| 6. Oral and Maxillofacial | $556,642 |

| 7. Radiation Oncology | $547,026 |

| 8. Cardiology | $544,201 |

| 9. Urology | $505,745 |

| 10. Radiology | $503,564 |

According to Peter Alperin, the Vice President of Product at Doximity,

Our report underscores the considerable pressures physicians face today, as they navigate a growing physician shortage, a tough economic environment, and a looming gender pay gap.

The most recent release of the Medscape Physician Compensation Report found that there was a 2.4% decrease in the overall average compensation for physicians last year.

While there was a slight decline in physician salaries across the board, some specialties saw fairly significant increases in pay last year.

Though it didn’t make the cut as one of the ten top-earning specialties, emergency medicine had the highest income growth last year, jumping over 6%.

Here are the top 5 specialties with the highest increases in income reported in the 2023 survey:

- Emergency Medicine: +6.2%

- Pediatric Infectious Disease: +4.9%

- Pediatric Rheumatology: +4.2%

- Preventive Medicine: +4.0%

- Pulmonology: +3.9%

Disclaimer—Regardless of your specialty, physicians are among the highest paid professionals out there. Make sure you’re protecting your income source against the unknown. Consider disability insurance for doctors to help keep your finances in order.

Highest Paid Doctors by State

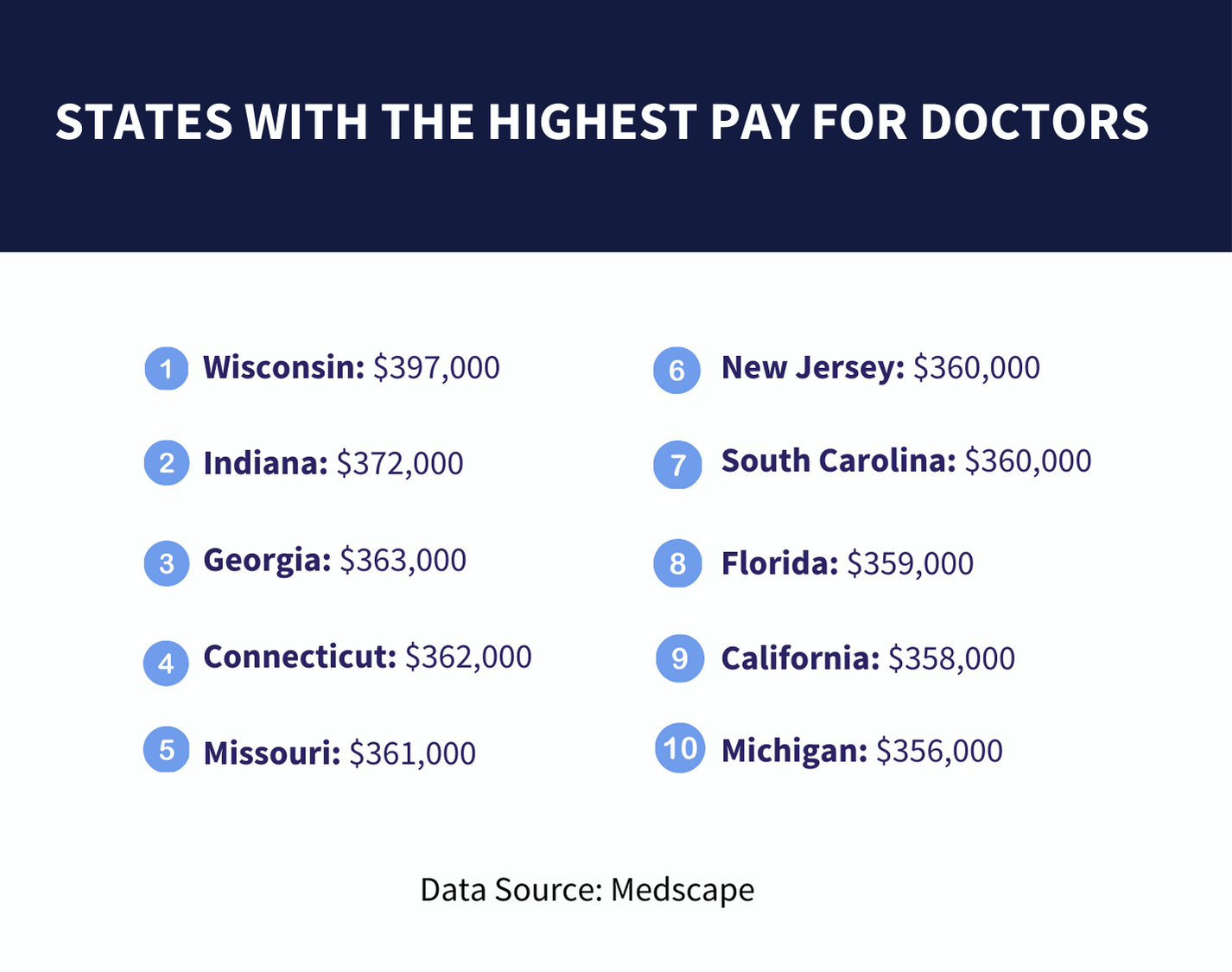

Your location can significantly impact how much you earn in many industries, and the medical field is no exception. Medscape’s compensation report pinpointed which states are home to the highest paid doctors.

Based on their findings, Wisconsin is the state with the highest paid doctors—physicians in the state earn an average of $397,000 per year.

The graphic below highlights the ten states with the highest pay for doctors:

While you might expect the largest and most heavily populated states to have the highest pay for doctors, data suggests that isn’t always the case.

As you can see from the list, states like New York don’t even make the top 10. Neither do many of the states with the highest cost of living.

These types of areas tend to have more healthcare options available. The more practices there are, the fewer patients each physician has to take on. And many of the states with the highest pay for healthcare providers have more limited resources, creating a higher demand for local physicians and their services.

No matter where you practice, if you’re one of the highest paid doctors, consider growing your income with one of the best high yield savings accounts:

Additional Factors that Affect How Much Doctors Make

Your location and specialty aren’t the only factors that determine how much you earn as a doctor.

Income data suggests that these factors impact your earning potential, too:

- Type of Workplace

- Gender

- Degree

Let’s take a closer look at each one below.

Type of Workplace

The setting you choose to practice in can impact your compensation. Doximity’s 2023 survey found that single specialty group practitioners made the most, bringing in an average income of $438,959.

Here’s a breakdown of the average compensation for each type of medical practice:

- Single Specialty Group: $438,959

- Solo Practice: $428,112

- Multi-specialty Group: $421,159

- Health System, ACO, or IDN: $400,207

- Hospital: $398,954

- Pharmaceutical and Industry: $392,534

- Health Maintenance Organization: $387,393

- Academia: $347,013

- Government: $269,189

- Urgent Care Center or Chain: $264,727

Gender

Data suggests that the gender pay gap is alive and well in the medical field. Doximity cites the gap was 26% in their 2023 survey, with male physicians earning an average of $110,000 more per year than their female colleagues.

Using data from their last several surveys, they projected that male doctors earn $2 million more than their female colleagues over the span of their careers.

The gap is higher in some specialties than in others. Oral and maxillofacial surgery, allergy and immunology, and pediatric pulmonology have the largest gaps.

When it comes to specialists, Medscape reported a 27% gap between male and female doctors’ compensation in 2023. That gap has narrowed by 6% over the last two years.

Degree

Whether you have an MD or DO attached to your name, your earning potential as a doctor is high. In fact, income data shows that medical doctors and doctors of osteopathic medicine who are posted in the same position tend to earn close to the same incomes.

However, MDs are more likely to pursue more competitive and lucrative specialties and have a higher match rate in those medical jobs. For example, here’s a comparison of the number of matches for MD and DO seniors who ranked a specialty as their only choice in 2023:

| Specialty | MDs Matched | DOs Matched |

| Anesthesiology | 907 | 116 |

| Child Neurology | 106 | 15 |

| Dermatology | 115 | 11 |

| Neurosurgery | 197 | 3 |

| Plastic Surgery | 143 | 0 |

As you can see in the data above National Residency Matching Program’s 2023 report, more doctors match for competitive specialties than DOs. Whereas the playing field is more even in specialties like family medicine, where 1,363 MDs and 1,259 DOs matched.

Frequently Asked Questions

What type of doctor gets paid the most?

Neurosurgeons get paid the most of all doctor specialties, on average. A Doximity survey found that neurosurgeons earn an average of $788,313, followed by thoracic surgeons and orthopedic surgeons.

Keep Reading:

What is the lowest paid doctor?

Survey data shows that pediatricians earn the least out of all doctor specialties. In Doximity’s Physician Compensation Report, pediatric specialties made up the top five lowest-paid specialties in the medical field. However, pediatricians typically have to work fewer hours than some higher-paying specialties.

Keep Reading:

Do you get paid during residency?

Yes. Doctors do get paid during residency. As a new practitioner, your annual salary will be lower than what you eventually earn with more experience under your belt.

Resident salaries are usually based on what year of the program you’re in, rather than what your specialty is. Each institution sets its own resident salaries, so compensation can vary depending on where you train.

What is the job outlook for doctors and surgeons?

The Bureau of Labor Statistics projects a 3% growth rate in employment for doctors and physicians through 2032. The BLS also estimates there will be around 24,600 new job openings for physicians by 2032.

Bottom Line

Income data can be a useful tool, whether you’re just starting to consider medical school or it’s time for residency applications and you’re trying to decide on your specialty.

There are a lot of factors to consider as you decide on your career path as a doctor. Do you want to start a private practice or work in a hospital? Should you practice in a rural area or the city?

Do you want to be a cardiologist or dermatologist? One of your chief decisions will be choosing a specialty that fits your passions, interests, and skills. While earning potential shouldn’t be the only driving factor in your decisions, whether or not to become a doctor is certainly worth considering as you weigh your options.