You’ve decided to invest in real estate, and several people have been encouraging you to consider doing so via a real estate syndication, but you are wondering how to evaluate a real estate syndication deal to see if it’s worthwhile.

Real estate syndications are a great way to passively invest while still earning solid returns.

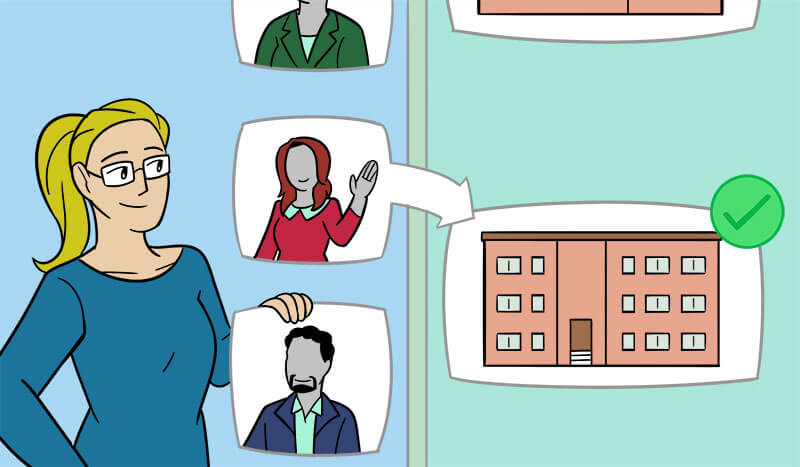

Investing in real estate syndications requires significant analysis upfront. In this three-part series, we take a look at how to analyze a real estate syndication. This step-by-step guide begins by looking at how to evaluate the syndication’s sponsor, which is the focus of today’s article.

So, without further ado, let’s dive right in.

The Role of the Sponsor

A sponsor is the person or team that champions all aspects of a real estate project on behalf of the equity investors. The sponsor is often referred to as the General Partner (GP), whereas the rest of the investors are Limited Partners (LPs). LPs take on a passive role in the project, which is why they’re often called “silent” or “passive” partners. As a result, LP investors also have limited liability – meaning their potential loss in a downside scenario is limited to the amount of their investment. Most physicians invest in real estate deals as LPs.

The LPs put a lot of trust in the sponsor, and it’s easy to see why. The sponsor has significant roles and responsibilities throughout a project’s lifecycle.

A sponsor’s role starts early on – months before investors even know a potential deal exists. The sponsor finds the deal, whether it’s on or off-market. The sponsor then negotiates the terms of the purchase and sale agreement. They’ll prepare investor marketing materials and assemble the equity capital and debt financing needed to acquire (and later, renovate) the property. The sponsor also oversees all pre-acquisition activities, including all due diligence (such as engaging specialists to provide third party reports and reviewing existing financial information, among other things).

Because of all the work that goes into evaluating, underwriting and preparing a deal for acquisition, sponsors will take an acquisition fee to cover related costs (and compensate them for this work, which they do even when a deal falls through).

Following acquisition, the sponsor then oversees operations and management of the property, including any planned renovations, leasing and maintenance. Depending on the size of a project, the sponsor may hire a third-party property manager to handle day-to-day management, but the sponsor will still oversee the entire process to ensure the deal’s objectives are being met. At the end of the day, the sponsor is solely responsible for all aspects of the project.

Throughout the project, the sponsor handles all the financial reporting, which is usually shared with investors in the form of a quarterly letter. They’ll submit drawdown requests to the lender, make payments to investors in accordance with the operating agreement, and engage accountants to prepare and distribute K-1s during tax season.

Lastly, the sponsor will arrange for the refinance or disposition of the property at the end of the investment period.

How Sponsors Make Money

Sponsors make money in a few different ways.

First, and as noted above, they’ll often take an acquisition fee for lining up and conducting all due diligence on a transaction.

Most sponsors will also directly invest in a deal, just like the LPs, though not to the same extent. Sponsors generally put about 5-10% (sometimes as much as 20%) of the equity into the deal. It’s important that the sponsor have at least 5% of the equity to ensure they have adequate “skin in the game” – this helps to align interests and indicates the sponsor’s confidence in its own work product. The remainder of the equity capital comes from the LP investors. A project’s entire capitalization is the sum of GP equity, LP equity and bank debt.

Another way to better align sponsor and investor incentives is to use a promote structure with a preferred return. In other words, an investor is entitled to a full return of their investment capital plus an additional return above a certain threshold (known as the “preferred return”). Above the preferred return, the sponsor will be entitled to a percentage of total returns – think of this as their performance fee as they are only entitled to this fee if the project performs above a certain threshold.

Many sponsors will also take some sort of annual asset management fee in connection with the project. The investment documents should clearly disclose what fees will be paid to the sponsor, how those fees will be distributed and when.

How to Evaluate a Sponsor

Given the important role of a sponsor in a real estate syndication, it’s imperative that the sponsor be highly qualified. The sponsor generally brings specific expertise to the project – whether about the local market or about the asset class (ideally, both). Investors should feel confident that the sponsor has a solid reputation, strong track record, the right debt and equity relationships and all other requisite skills and expertise needed to manage the project through its entire lifecycle. Not all sponsors are created equally. Some are much more qualified than others. How can you tell? Here are some key questions to ask when evaluating the capacity of a sponsor:

- How much experience does the sponsor have in the local market and with that asset class? For instance, someone who’s primarily worked with retail or office properties likely isn’t qualified to sponsor the acquisition of a 100+ unit apartment building. A sponsor likely has more insight into, or resources in, markets in which it already has offices, employees or investments.

- Does the GP spearhead syndications for a living? This should go without saying, but to be clear: you’ll want to be sure the GP isn’t doing this syndication as a one-off pet project. It’s always best to invest with someone who earns a living by managing syndications on behalf of investors like yourself. That’s how they will have gained the experience needed to be successful.

- What is the reputation of the general partners? To start, you’ve got to trust the people managing your cash. The best way to learn about the GPs is to talk to past investors. Anyone asking for your business should provide references on request. It’s perfectly reasonable to ask those references if they were satisfied with their returns and if the investor relations packages were timely and thorough.

Do a little cyberstalking before handing over your cash to any real estate syndication. LinkedIn, Google, even Instagram tell you a lot about an investor’s professionalism, or at least their marketing skills. At a minimum, the GPs should have a professional social media presence and a polished website. The reputation of the GP also affects the deals they see and secure. Investors and brokers will approach a GP with a solid reputation first and may choose who they sell to based on their social presence. A respected investor with a reputation for closing fast and keeping their word will get a phone call from a broker with a hot deal before an inexperienced GP. A good reputation leads to more investment opportunities and higher quality deal flow.

In addition to the partners, who else does the sponsor have on their team? At this point, you should have already done some research about the general partners sponsoring the deal. But in addition to the partners, you should take a look at who else is on their team. This includes those directly employed by the sponsor (e.g., analysts, project managers, construction managers and others who could be involved in the day-to-day of the deal) as well as third-parties, such as the construction team, marketing team, property manager and attorney. Ask the following questions about the team:

- What is each person’s or group’s individual role and responsibility? It should be clear who will be managing which aspects of the deal.

- What experience does each team member have that they’ll be bringing to the table? You don’t want an overly-bloated team if each person doesn’t add specific value. Be sure the person’s experience is tied to what their expected role and responsibility will be.

- Has this specific team done deals together before? If so, what were those deals and how did they perform? If there were different team members involved, such as a different construction manager, ask why the GPs made the shift. Was there something that happened with the last syndication that caused the GP to swap out team members? You might probe further by following up with the group no longer on the team to ask for their side of the story. It may be that a team member wasn’t fired by the GP, but for one reason or another, decided they didn’t want to work with the GP again – something that happens often and is very telling.

- Who’s missing from the team? The team may not be fully built out yet, in which case, you’ll want to know which roles still need to be filled. Ask the GP to explain how those roles will be filled and by whom.

- What’s the contingency plan if something happens to the GP and/or another key team member? In a worst-case scenario, say, one of the GPs dies unexpectedly, you’ll want to know that the syndication sponsors can still see the deal through to completion.

- Who is the property manager? We touched upon this above already, as the property manager is a key team member. But it’s worth having the GP provide more robust information about the property manager, specifically, given the importance the property manager plays in leasing up and stabilizing a property. Probe further about how many properties they manage, what asset classes they manage, and the size of the properties currently under management. You’ll want to be sure they have experience in the same submarket you’re looking to invest in, as each submarket has hyper-local nuances that property managers need to contend with.

Definitely check out the property manager’s website. You might also want to unexpectedly pop in and request a tour of one of the properties they manage, which should be easy to do for those who manage larger properties like apartment communities.

- How have the sponsors’ previous deals performed? Any sponsors should be able to provide you data on previous acquisitions. Details on past projects, including the timeline, returns, and how the results compared to their projections, should be readily available to you. A veteran syndicator who’s been in business for decades will not have a perfect track record, and that is to be expected. Any syndicator that’s never made a mistake hasn’t been in the real estate business long enough. Even the best real estate moguls don’t make a killing on every single deal. However, the bulk of past projects should have performed well before you consider investing in a real estate syndication.

- Has the sponsor experienced (and survived) multiple real estate cycles? There’s no substitute for experience. The real estate market moves in cycles. Buying, selling, and financing real estate in a downturn is not the same as operating in a market where everything is coming up roses. Simply living through a real estate cycle and experiencing a few rough years is sure to teach any real estate investor a few tricks. Try to find a real estate syndication led by folks who remember what the last downturn was like. Understanding the sensitivity of rent, property values and interest rates to the general economy takes practice and a new GP won’t haven’t that expertise unless he or she has recruited some veterans to the team. The bios of the team should be available on the website for your review so you should be able to readily see how long they have worked in real estate.

- How many deals has the GP done? It’s not just the years, it’s the miles. Time in the market matters, but the number of properties bought and sold matters too. While every real estate deal is unique, the more deals GP has done, the more likely they will have the expertise needed to anticipate and handle any bumps in the road. Something goes wrong on every real estate deal and investors that have done multiple syndicated deals will see trouble coming. Knowing how to build uncertainty unto financial models is a skill learned by analyzing and executing multiple deals.

- Have any of the sponsor’s prior development projects failed to meet expectations? Ask the sponsors to elaborate. This isn’t always a red flag. Related to the point above, a sponsor that has been in business through multiple real estate cycles will likely have some blemishes on their record—it’s just important to understand what happened and how they course-corrected. You’ll want to know that even when a project hits a snag, the sponsor is committed to providing timely and accurate information to investors.

- How capable is the sponsor in terms of evaluating risks? Every project carries some degree of risk. You’ll want the sponsor to be honest about the project risks, and then explain how they plan to mitigate those risks during the project’s life cycle. More experienced sponsors will be transparent about these risks (e.g., a looming recession), how they may impact the property and what steps they’ll take (or have already taken) to minimize the downside scenario.

- How does the company identify other equity investors and arrange debt? You’ll want to know whether the sponsor lines up equity investment through a fund, through personal relationships, via crowdfunding or other avenues. In terms of debt, does the sponsor use a debt broker or does the sponsor have particularly strong relationships with certain banks? (A sponsor who has longstanding relationships with their debt partners is in a much better position to navigate through a recession.) Also ask about what sort of rates they expect to get on this project. Are they completely subject to the debt capital markets or are they able to source “better than market” debt by leveraging existing bank relationships?

- What systems does the sponsor have in place to ensure proper management of the project? Evaluate their processes end-to-end, from financing to renovation all the way through leasing and stabilization. You’ll want to be sure the sponsor is very deliberate in how it manages the project – an ad hoc approach creates too much execution risk.

- Are the sponsor’s fees logical? Anyone who’s considering investing passively in a syndication will want to thoroughly vet the project sponsor. One thing to look at is the sponsor’s fees. Most sponsors will charge a small acquisition fee (approximately 1%) for finding a deal. Other fees will range depending on the type of deal. A development project, or one that requires construction management, will generally range from 3% to 5% of total project costs. Be sure that all the sponsor’s fees are in line with industry averages unless there are extenuating circumstances.

The Importance

As you can see, the sponsor is perhaps the most critical factor in a real estate syndication’s success, so it’s important to work with someone that’s highly-qualified and has a proven track record. When investing in syndications, be sure to understand who you’re working with, what they’re responsible for and how they plan to execute on the project’s business plan. As a passive LP investor, your decision-making authority is very limited after you make your decision to invest. For this reason, put the time in upfront to learn about your new investment partners as you’ll be spending the next 3-5+ years in this relationship.