How can you buy a house in 2024 with almost no money? Are you tired of hearing stories about people who bought real estate pre-2008 and now they’re loaded? Me too.

Those stories are inspirational, but not always helpful. Let’s talk about how to start investing in real estate right now, even if you don’t have much cash to invest.

I realized shortly after undergrad that I needed to start investing in real estate to build wealth, but I had almost no money. I was already sold on the need for passive income as I’d just finished reading Rich Dad Poor Dad.

It’s no secret that the wealthy make their money work for them, instead of trading their time for cash. I wanted to do the same, but I wasn’t exactly rolling in the dough.

So how did I get started in real estate investing?

My House Hacking Experience: My First Multifamily

The term “house hacking” hadn’t been coined yet (by Brandon Turner at Bigger Pockets), but that’s exactly what I did.

With a total of $8,000 from selling my CD collection and raiding my nascent IRA, my boyfriend (now spouse) and I bought a fixer-upper duplex in Woburn, MA from a family friend.

With the upstairs tenants paying the mortgage, we had enough left over every month for the rehab. Two years later, we sold, collected a tidy profit, and fled New England winters forever (apologies to any readers in snowy locations). While I wouldn’t recommend living in a house you’re gutting, the money we earned was life-changing and let us move to Southern California.

Of course, that was a long time ago and the market has changed. You’re not here for my story from the pre-2008 crash anyway – you want to know how can you can house hack in today’s market – without a lot of cash. If I were starting all over again, what would I recommend to start who wants to start investing in real estate without a lot of money? (Disclaimer: yes, there is some risk involved and anyone who tells you that you can make a lot of money without taking on risk is lying to you.)

What is House Hacking?

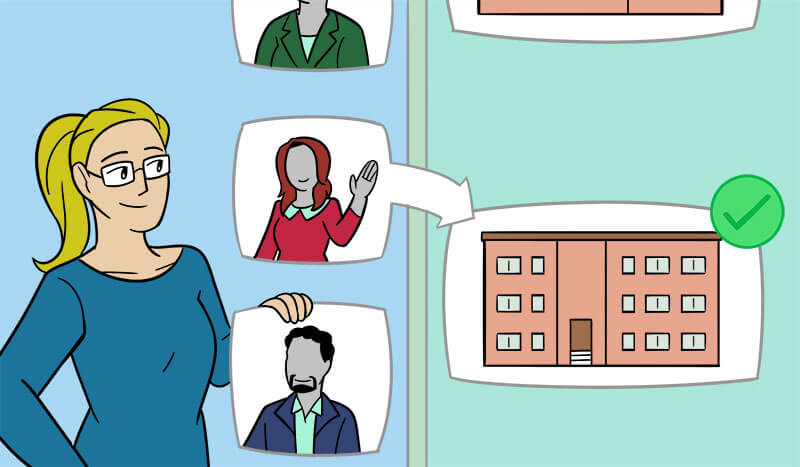

“House Hacking” is using your home as a way to generate passive income while you still live there. The idea of house hacking has grown to encompass any way to earn income off your primary residence in order to reduce your cost of living.

House hacking has the same benefits as buying a traditional home, such as a lower down payment and better interest rates, as well as the mortgage tax deduction, while also having the benefits of owning a real estate.

How would you like someone else to pay your mortgage for you? With house hacking, someone else pays for your home, in exchange for using a little piece of your house. Think of house hacking as a financial strategy to decrease your cost of living.

How Can You Start House Hacking?

Do you have an accessory dwelling or mother-in-law suite to rent out? An apartment over your garage, a room in your house or even a basement suite? No room inside? Then look outside!

Renting out a garage, driveway, or parking space in parts of the country short on parking or storage can turn your house into an income stream.

The simplest house hack though is to just buy something made for multiple families – a multi-family! Anything under 4 units still qualifies for a conventional mortgage with a low down payment.

Can Doctors House Hack?

Yes! Doctors have an extraordinary advantage here – they are able to qualify for a physician mortgage.

These loans may have as little as $0 down and require no Private Mortgage Insurance – a type of insurance most people pay when their down payment is less than 20% – since doctors have a default mortgage rate of 0.2%, compared to the 1.2% typical of the general population.

House Hacking: What’s the Downside?

There are a few pitfalls to understand when house hacking.

- Tenants are not your friends. Living close to your tenants means it’s easy to develop a social relationship with them, but taking landlord duties seriously needs to be the first priority. Setting boundaries is crucial in order to have a successful landlord-tenant relationship. Your friend wouldn’t expect you to fix their toilet after all, but your tenants will.

- You give up some privacy. Someone shares your space in any form of house hack. A multi-family minimizes this, but you still inhabit the same building and will know every time your tenants have a party. Because you’re downstairs (and maybe not invited.)

- Oh, and it’s work! Being a landlord does take up some of your time and there is no getting around that.

You Can House Hack!

If you’ve convinced yourself you can’t buy or can never live in the part of town you want, take another look and see if house-hacking can work with your lifestyle.

Or if you’ve been wanting to get your feet wet with real estate investing and want to dip a toe in the pool, house hacking can be a great place to start. Start making your home pay you instead of working to pay for your home!

I love house hacking and so will you. Need a place to start? Reach out to me for some advice on what to do at drcathycarroll@gmail.com.