Have you ever driven by a massive skyscraper and wondered about the billionaire that owned it? Chances are that complex is not owned by one exceedingly wealthy individual but by a group of investors in a syndication. Syndications buy and operate properties too large for the average individual to acquire alone. If you’ve never heard of a syndication, you’re not alone. In the past, syndications were limited to the wealthy and well connected. Syndications are now available more widely than ever before, with minimum investments that put them within reach of many investors.

What is Syndication?

What is Syndication?

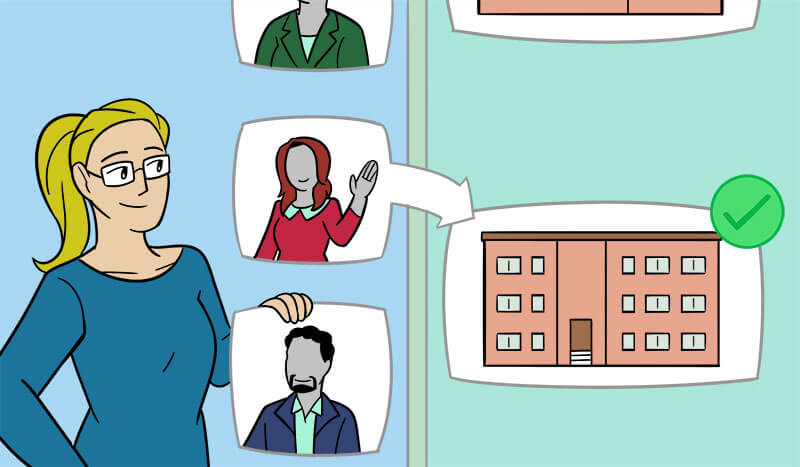

A syndication is a group of investors who pool their money to purchase real estate. A syndication is not you and your brother-in-law getting together to buy a duplex. Most syndications raise millions of dollars and purchase assets worth $2 million or more. After all, if two or three people could buy a property, you wouldn’t need to form a syndication in the first place.

Professional real estate investors, called sponsors or general partners, form a syndication so that they can buy large properties but they couldn’t fight on their own. These professional investors or general partners (GPs) contribute their own money to the deal. However, they still need additional funds to purchase the property, because the property is so large. This is where the investors come in. Investors, or limited partners, provide the rest of the cash for deals in exchange for part of the profits. The sponsor, aka the general partner contributes anywhere from 5 to 20% of the initial equity, and investors make up the difference.

How Does an Investor in a Syndication Make Money?

Suppose a syndication buys RBB (Really Big Building), a 400 unit apartment building in Florida. RBB Court sells for $50 million and the bank requires a 30% down payment for a loan of the remaining $35 million. The general partners contribute $1.5 million dollars of the down payment and turn to investors (or limited partners) for the remaining $13.5 million of the required equity. The GPs and LPs pool their money together to buy the apartment through a real estate syndication.

For the next 5 years, the syndication fixes up RBB, raises the rents and finds ways to make RBB more profitable. During this 5 year period, the syndication sends its investors a portion of the profits from the rental income RBB generates every quarter. 5 years after starting the syndication, RBB sells for $65 million. The investors now receive all their initial investment back, plus a portion of the $15 million in profits from the sale. In addition, for that five-year period, they were all receiving quarterly payments the whole time

How Much Can I Make If I Invest In A Syndication?

As always, past performance is no guarantee of future performance. On average, syndications return about 8 to 15% to investors. A typical holding period is three to five years, But a syndication indication could be as short as six months or as long as 10 years. If you invest $50,000 in syndication with an 8% preferred return but a projected total IRR of 15%, you’ll receive $4,000 a year. assuming syndication runs for 5 years. At the end of five years when the building is sold or refinanced, you receive your entire initial investment back. You also receive a percentage of profits from the sale, bringing your total return to the projected IRR of 15%.

Why Would I Invest In Real Estate Syndication Instead Of Buying Real Estate Directly?

Real estate syndications are a passive way to invest in real estate. The average investor does not have the time or desire to constantly hunt for profitable real estate deals. And the work doesn’t end when you buy – most people have no interest in managing high-rise office buildings or apartment complexes either. Investing in a real estate syndication allows you to participate in the real estate market while leveraging the expertise of professionals and avoiding the hassles of day-to-day management.

Isn’t a Syndication Just a REIT?

No. Not at all. A REIT is a real estate investment trust, which is very similar to a mutual fund. It is publicly traded (which means you buy and sell it fast on eTrade) and it owns many different real estate assets. A syndication is not publicly traded and usually owns one thing. Syndications have historically earned more money than REITs as well. REIT prices also move in a similar fashion to the stock market while real estate values do not track the stock market movements to the same degree. Syndications can also offer significant tax advantages over a REIT, depending on your individual tax situation.

What Are The Advantages Of Investing In Real Estate Syndication?

Portfolio Diversification

Most financial advisers will (correctly) tell you not to put all your eggs in one basket. An investment portfolio needs different kinds of investments, or asset classes, to minimize the risk. If the stock market tanks, real estate might do just fine. Just as most people should have a mix of different types of stocks and bonds, real estate syndications can be a profitable addition to a portfolio that offers diversification into a new asset class.

Passive Income

Syndications provide real estate exposure to your portfolio without the hassle of owning property directly. No toilets, tenants or evictions. You don’t have to worry about the bookkeeping and accounting either. The GPs take do all the heavy lifting and you collect a check.

Leverage Other People’s Connections

Some of the best real estate deals never hit the open market. Connections are key in real estate and without being part of the club, the most profitable deals will pass you by. The GPs in a syndication network constantly, allowing them to find deals the average investor will never have access to.

Benefits from a professionals expertise

Syndicators have done this before – they know what you need to do to squeeze every dollar out of a property and what changes will raise its price the most. You can choose to invest with sponsors who have years of experience in up and down markets, as opposed to struggling through on your own.

Access Larger Deals

Let’s face it, you make more money when you can do anything on a large scale. There is plenty of money to be made in single-family homes and duplexes, but it’s hard to top the money you can make trading skyscrapers, mobile home parks or apartment complexes. By pooling your money with other investors, you can access large deals you couldn’t take on alone.

Minimize Downside Risk

You can only lose what you invest and nothing more. As another who has ever owned a money pit of a home can tell you, when you buy real estate directly, sometimes you wind up spending far more than you intended. Unexpected repairs or a lawsuit can turn your projected windfall upside down fast. By investing in a real estate syndication, you can only lose what you choose to invest.

Protect your personal credit

No need to start piling debt onto your personal credit report – the syndication gets it own loan from the bank, totally independent from your credit. Applying for bank loans yourself to purchase real estate directly often leads to a hit on your personal credit. The syndication’s debt does not affect your credit score, any more than buying a mutual fund would.

Cash Flow

Most syndication spin-off monthly or quarterly cash flow, in addition to the payout at the end of the deal. There are few things as satisfying as seeing a check in the mailbox every month that didn’t require trading your time for money.

Taxes

The IRS loves real estate – the tax code in the US allows investors in real estate syndication to enjoy the benefits of depreciation. Although this depends on your individual tax situation, real estate generally enjoys favorable taxation compared to other investments.

What are the Disadvantages of a Real Estate Syndication?

Illiquidity

Unlike a mutual fund or other assets most investors are familiar with, syndications are illiquid. Which is a fancy way of saying you can’t hop on eTrade and buy or sell it in an instant. You purchase the syndications from the sponsor, which is the group that runs the syndication. You often can’t sell the syndication at all, but rather have to wait until the syndication sells or refinances the real estate owned to recoup your initial investment. This is typically 3-5 years, but each syndication is different. It is sometimes possible to sell your interest in a syndication directly to another investor, but this is not always possible and is at the discretion of the sponsor.

Limited (sometimes) to accredited or sophisticated investors.

Not everyone can invest in a syndication, as some syndications are only open to accredited or sophisticated investors. Anyone can hop on Vanguard.com and buy an S&P 500 Index fund. Your net worth doesn’t matter. However, certain investments, including syndications, limit who can participate. Not all syndications have this limitation. Many syndications bare restricted to accredited or ophistaged investors or will only allow a limited number of people who don’t qualify as such.

The timeline can change

What investing in a syndication, flexibility in your timeline is a requirement. Most syndications deliberately give only an estimate of when you’ll receive your initial capital back. If you absolutely have to have your cashback in exactly 5 years, a syndication is not for you. So why doesn’t the syndication end on a fixed deadline? If five years go by, and the syndication is supposed to end, but we’re in the middle of a real estate downturn, everyone loses money if the syndication sells in the middle of a recession. By waiting another year, the real estate market can improve, and all the investors benefit. To avoid being forced to sell in a market downturn, syndications give a range ut when the investment will end but don’t commit to a specific date.

How Does the Sponsor In a Syndication Make Money?

How Does the Sponsor In a Syndication Make Money?

GPs participate in the equity upside of the deal, meaning they received a portion of the cash flows after investors are paid, and a portion of the profit at the time or sale or refinancing., Each syndication is unique but there are fees paid to GPs in addition to the equity participation. The fees a sponsor earns are spelled out in the PPM, or private placement memorandum. Each deals varies but typical fees paid to sponsors are:

Acquisition (Or Transaction) Fee

1%-3% of the transaction value. sponsors can look at over a hundred deals before they find the right one, and use these fees to offset the cost of inspections, travel and any money spent to find and vet deals.

Asset Management Fee

The general partners manage the asset, including supervising the property manager, hiring and managing contractors for renovations, ensuring all the bookkeeping and accounting is up-to-date and communicating with investors. Asset Management fees run 1 to 2% of gross revenue generated by the property.

Disposition Fee

Sponsors typically earn 1 to 2% of the sales price of an asset at the end of the deal. This is a one time fee to reimburse the sponsor for the expenses incurred at the time of sale, like marketing expenses.

How Do I Analyze a Syndication?

Vetting a syndication is crucial before deciding to invest. The sponsor’s reputation and the success rate is the most important factor. Location, location, location still applies. The financial assumptions in the PPM (private placement memorandum) should be reasonable. The financing terms matter too – expensive debt lowers everyone’s profits. The waterfall or split distribution of profits is what aligns the interests of the sponsors with investors, making it worth a detailed read. Some sponsors offer multiple investor classes with different rates of return for each, giving you another choice to make.

How Do I find a Syndication to Invest in?

Finding the right sponsor to invest with is the hardest part! Talk to successful investors you know or contact us for guidance on reliable syndicators. We can point you in the right direction, depending on your investing goals.

If you have more questions about what you read, feel free to reach out to me at drcathycarroll@gmail.com.