The most common item we see physicians have missing when it comes to their estate plans is that they completely forget about their digital assets.

When planning an estate, the big-ticket items typically come to mind first, and they should: your will, your major assets, your bank accounts. Determining what will happen to your house and retirement accounts after you die is equally as important. Making sure your dependents or spouse are taken care of financially are key. You need to make decisions about possible charitable giving, and what to do with control of your business, should you own your practice.

After all of that, what could possibly be left, right?

As time and technology have moved us forward, the types of collateral we accrue throughout our lives increases. We know one person who has decided that he would make digitizing and archiving decades of family photos his retirement project. This way, he will leave hundreds of priceless, irreplaceable images to his loved ones to enjoy for years to come. This project will probably take months to complete.

His is an example of the value we place on time, on memories, and on the ways big and small that we connect with others. When it comes to a digital estate, those photos, emails, and voice mail messages seem inconsequential as individual moments, but together, they add up to create a record of a lifetime.

Likewise, some digital assets have a monetary value. There are bank accounts that exist entirely online, brokerage accounts that are online as well, and endless bits of data pertaining to business dealings stored in the Cloud. And then of course there are crypto assets like bitcoin that have risen in popularity.

What has monetary value is pretty much set by society, but what has sentimental value is really determined by you. What we know for sure is that it would be a shame for all of these digital artifacts to vanish due to a lack of planning.

Have you ever wondered what to do with your paper photos, your CDs, or even your old floppy disks? Technological evolution occurs every ten years or so, but it’s getting faster all the time. This is good, because with changes in technology, comes new conveniences to our lives. The downside, though, is the risk of loss once the digital format becomes obsolete, or if your data becomes inaccessible.

Your presence will be missed but doesn’t have to be.

What is digital estate planning?

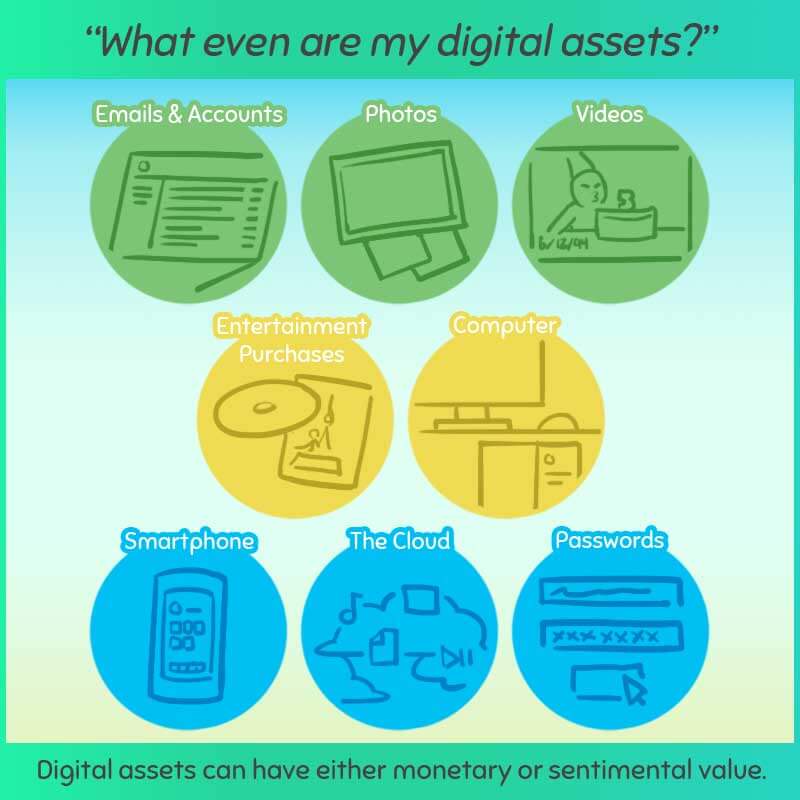

Digital estate planning is the process of organizing all of your digital monetary and sentimental assets and making formalized, legal arrangements for what should happen to that property and information after your death.

If you have computing hardware, and we know you do, you’ll want to have a record of where your information is stored as well as how to access it. That record needs to be in a secure location, accessible only by your designee, so as to protect your privacy and your valuables, even and especially after your death.

Computers, external hard drives, tablets, smartphones, and even digital music players, e-readers, and digital cameras should be considered. Don’t forget hard copies of photos that you may wish to have digitized for posterity, and passwords, and access to all of your online information and accounts.

What digital assets do you own?

The first step to creating your digital estate is to identify your own digital assets. Remember that the legal definition of an asset is that an item has monetary value. For your own digital estate, be sure to include items of sentimental value as well. Anything that you wish to last beyond your life is an item of value to you. Having a plan in place to preserve memories and personal artifacts is something you won’t regret.

Emails:

Emails have somehow become integral to how we communicate. You likely have a large number of emails filed away, perhaps between different email accounts. Take some time to sift through those accounts. Delete anything not worth keeping. Anything you hesitate to delete, save. Emails can be related to your business or other financial matters. They could also have tremendous sentimental value. That file of emails sent to you by your mother or father who has now passed away? Save those.

Photos:

Depending on your age, you may have scores of paper photos documenting your childhood. Chances are that your family has photos of relatives going back several generations. These documents are precious and should be preserved. They tell your history. The idea of digitizing a vast store of photos can certainly be daunting. There is a lot of time involved in such a project. Plus, what if, once you have digitized everything, the technology changes again? Will you have wasted your time? There are services where you can pay someone else to make a digital archive of your photos for you. The time you may save having this done could be well worth the cost if you find this type of project daunting.

Videos:

Videos are another type of technology that has changed much over the years. You may have video files on your smartphone or a YouTube channel, or you may still have some VHS tapes and DVDs gathering dust on a shelf somewhere. Either way, the ability to preserve home movies is priceless. If you are a movie buff, you may wish to archive and preserve your DVD collection. It is possible to convert VHS or DVD files to digital formats. Be sure to curate files that are already digital to decide which you want to keep while deleting the outtakes.

Entertainment purchases:

For those of us with considerable collections of entertainment media, we likely have spent a pretty penny accumulating that collection. It’s worth taking the time to go through your home to decide what you want to keep. Do you want to archive the videos you have purchased through iTunes, or the DVDs taking up space in your basement?

Computer:

Deciding what to archive on your computer might be the most daunting part of a digital estate audit. This is simply because we keep so much information on our machines. If you have a work computer and a personal computer, this becomes even more challenging. Set aside some time to go through old files and see what you want to keep and what you forgot you even had. Be sure to keep financial documents and anything needed for insurance purposes.

Smartphone:

Ah, the smartphone. Did you know that an estimated 96% of Americans now have a smartphone? We store everything on them. Movies, emails, photos (so many photos), documents, travel itineraries, banking information, music, the list just keeps going. Do you know how to access your smartphone should you forget your login ID or your face scanner stops working?

Cloud:

Technologically speaking, the Cloud is a relatively new concept. Could you name, right now, everything you have stored in the cloud, and how you could access it quickly? Do you own a website? What about a photo share site? If you own any Apple products or use Google, chances are you have a lot of information in the Cloud.

Email accounts:

It’s not uncommon for people to have multiple email accounts these days. Some people still have email accounts dating back to their college years, and most people have at least one personal and one professional email account. If your email account disappeared one day, would it bother you? Would you lose valuable information? While there are some days I wish email never existed (looking at my 100’s of emails a day!) there would be a considerable loss of information that would cause some real financial issues if my email was ever deleted.

Contacts:

Consider your contact list. There was a time when most people kept track of their contacts with a good old-fashioned address book and a pen. These days, just about everything is in everyone’s phone, via the Cloud.

Why should I create a digital estate plan?

Creating a digital estate plan helps you preserve your monetary and personal effects, your digital assets. This is first and foremost the best reason to go through the trouble.

Making a digital estate plan certainly sounds like a lot of bother, doesn’t it? There are so many bits and pieces of our lives stored on devices, in the Cloud, and in different accounts that it can be quite time consuming to gather all of the information together. That is also why now is the best time to get started. Compiling your digital estate won’t – and shouldn’t – be done in a day, or even a week, or possibly a month. Once you have your list of components that you need to archive, it becomes easy to break down creating your plan, piece by manageable piece.

An archive of your life and that of your family is priceless and irreplaceable. The technology on which these memories are stored – including paper – will change, probably in our lifetime. Don’t let procrastination steal your memories.

Whether or not you consider monetary value more or less important than sentimental value, there are likely monies associated with your retirement accounts, savings accounts, and any other financial information you have stored electronically. Make sure your digital estate manager has access to this important information, these digital assets likely carry some real value.

And, just like with your primary estate planning, your digital estate planning will be a help to your family after you die. If you think pulling all of your accounts together now is difficult, imagine how tough it will be for other people to do, without you around to point them in the right direction.

Items to add to your digital estate:

You will need to customize the list to suit your needs, but this will get you started.

| Type of Item | Stored Electronically | Stored Physically | Password Required |

| Blog accounts | Yes | Yes | |

| Credit card accounts | Yes | Yes | |

| Credit card rewards/points programs | Yes | Yes | |

| Domain names | Yes | Yes | |

| Email account – personal | Yes | Yes | |

| Email account – business | Yes | Yes | |

| E-books | Yes | Yes (on device) | Possibly |

| Flash drives | Yes | No | |

| Music | Yes | Possibly | Yes, if stored electronically |

| Online store accounts, ex. Etsy or eBay | Yes | Yes | |

| Online subscriptions | Yes | Yes | |

| Retail and shopping accounts | Yes | Yes

(key tag/barcode) |

Phone number |

Are passwords considered part of your digital estate?

Passwords are a strange beast. We need them to protect our data. It makes good sense to follow all of the protocols: don’t write them down where other people can find them, don’t use the same password for all of your accounts, and for goodness’ sake, don’t use your birthday as your password.

But, with all of the email accounts, retirement accounts, retail accounts, and even the U.S. Post Office requiring you to set up an account to buy anything online, how on earth is a person expected to remember all of their passwords without writing them down, using the same password for all of the accounts, or using something easy to remember, such as your birthday?

Luckily, there are a few solutions. There are quite a few password management programs and apps available. We can’t endorse anyone in particular, but if you do a quick search on “password management,” you can find all that you need.

Once you have listed everything you have, it’s time to make some decisions. What material should be archived? There are probably plenty of photos and emails that you don’t need. Likewise, you may not need to keep every account statement for each account. Decide what material can be deleted and what should stay. You will likely know right away if something should stay or go. If you hesitate on anything, keep it just to be safe.

Name a digital executor of your estate

Just like with a traditional estate, you will need to formally name an executor to manage your digital estate. This could be someone you hire, such as an attorney, or it could simply be someone you trust implicitly. This person will need access to all of your passwords, so be sure to choose wisely.

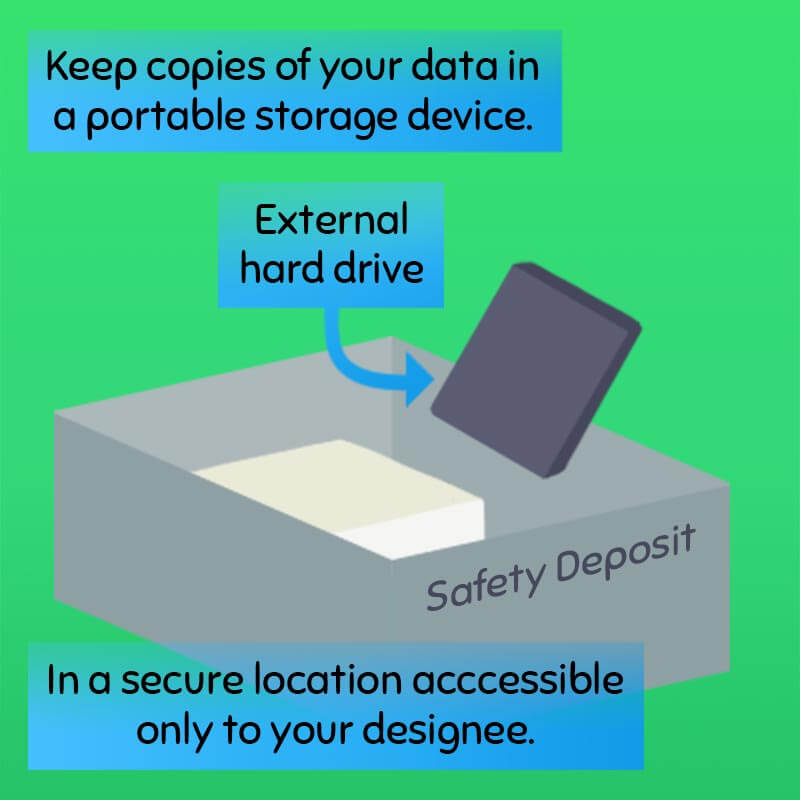

Keep a backup of all of your passwords, so that they never exist solely in one place or with one person. They should never be stored on your computer itself. It’s too easy to hack.

I’ve created my plan, now what?

Once you have gathered your information and have chosen the person to be your executor, it’s time to decide where to store the information for safekeeping. You will likely have created several documents with account information and passwords, as well as possibly some thumb drives containing files.

You will need a secure but accessible location to store these items. We recommend storing your digital estate with your attorney if possible. Other locations are a safe deposit box at a bank or credit union, or in a locked cabinet or safe.

Finally, be sure to formalize your plan

Any estate plan needs to be legally binding in order for you and your intellectual property to be truly protected. Just like with a traditional estate plan, having a lawyer look over everything and ensure that the right person or entity has control of your passwords and other data is key. Start by calling the attorney who created your traditional estate plan, and see if they also aid in creating digital estate plans or if they can recommend someone for you.

Your digital estate plan should be part of your traditional estate, minus your passwords. Those should be kept safely with your digital estate plan executor and/or any professional data storage company you use.

You may also want to consider backing up all of your information on a portable, external hard drive. It’s possible to buy a hard drive external to your computer that is very small in physical size but that can hold a remarkable amount of data. Then, put the hard drive in your safe deposit box, waterproof or fireproof safe, and know that your money, your memories, and your mind can rest easy.