Every physician should have a revocable living trust in place to protect your assets and provide peace of mind. You may be asking yourself: Isn’t having a will enough? Haven’t I already taken the steps necessary to ensure that my affairs are managed even after I die?

A will is an excellent document to have. This holds especially true for physicians.

Though you may not feel wealthy, given all of that student debt plus expenses from your private practice should you go that route, you do earn a healthy salary. In fact, you earn more than the average American, by far.

So, it makes good sense to protect the assets that come with having an above-average salary. The key to remember, though, is that protecting your assets for after you die is simply not enough.

You must also ask yourself: what do I do to ensure that I am taken care of while still alive, should I not be able to make decisions for myself.

We get it, we really do. Physicians often feel invincible. You have spent most of your adult life working hours unimaginable by most people. Not only working long hours, but you also do them on little sleep, with little food, and along the way, you save lives. You strive to keep your patients healthy.

These are not small things!

So we understand entirely that the last thing on your mind might be what steps to take to address times when you might be incapacitated. Who even wants to think like that, regardless of profession?

The truth is that by having a revocable living trust, you are not only protecting yourself should the unthinkable happen, but you are also creating peace of mind for yourself starting right here, right now.

What is a Living Trust?

A living trust is a legal document created while you are still living that allows for a person you designate to make decisions regarding your medical well-being and financial assets.

This document is legally enforceable, and so requires legalization. This means that it’s not enough to simply write your wishes down on a piece of paper. You should, at a minimum, have the document notarized. At best, you should have a lawyer draft the document for you to ensure enforceability.

Types of Living Trusts

Revocable Living Trusts

This is exactly what it sounds like. You can revoke it, aka change your mind.

How Does a Revocable Living Trust Work?

The name of the document really does say it all. A revocable living trust is a way for physicians to legally entrust your affairs and estate to the oversight of a trusted individual whom you designate should the need for such oversight arise.

You then transfer your assets into the trust. Your name does not go on the trust as the title. Rather, the trust will have its own name separate from you. This is key so that should you become incapacitated, the person you have designated as your trustee technically makes decisions for the trust, not for you as an individual.

What Else is a Revocable Living Trust Good For?

A revocable living trust can serve as a vehicle for saving taxes for your estate and thus your beneficiaries.

Another key benefit is if minor children are involved. Revocable living trusts for physicians can be written to adhere to any terms you wish. For example, you may wish to set up terms so that your children receive set portions of your estate at certain times in their lives, e.g. all of it at age 21, or half at age 21 and a half at age 30, or whatever you choose.

This is particularly useful for people of particular means who have minor children. Bestowing a large amount of money on a minor child or even a fairly young adult child may be more of a burden than a gift.

A revocable living trust will help ensure your privacy which is a really nice benefit as a physician. Wills are public record, but a living trust is a private document. Without a trust, the terms of your will could be made public. This is often not ideal for most physicians, either due to privacy concerns, due to a large number of assets within the trust, or both.

Irrevocable Living Trusts

This is also what it sounds like. Once you die, it stays as-is. Make your decisions wisely and with the advice of legal counsel.

Why Should Physicians Have a Living Trust?

Having a will is not enough. After all, you’re a doctor. You know that life can change in an instant, and you can go from the strong, healthy vibrant person you are right now, to someone who needs long-term, managed care.

Estate planning is about more than simply drafting a will. An estate plan is comprehensive, and a well-written plan includes the all-important component of estate planning that addresses what happens while you are alive.

Have you asked yourself what happens if you become incapacitated? What are your wishes? Does anyone know? What happens if something happens to them and they cannot advocate for you? Who do you trust to make decisions for your care? What are your wishes for things such as heroic measures, life support, or organ donation?

As a physician, you need a living trust as well. Living trusts for doctors are just as important as trusts for everyone else, perhaps more important due to the special circumstances that surround physicians.

Roles of Everyone Involved in Your Living Trust

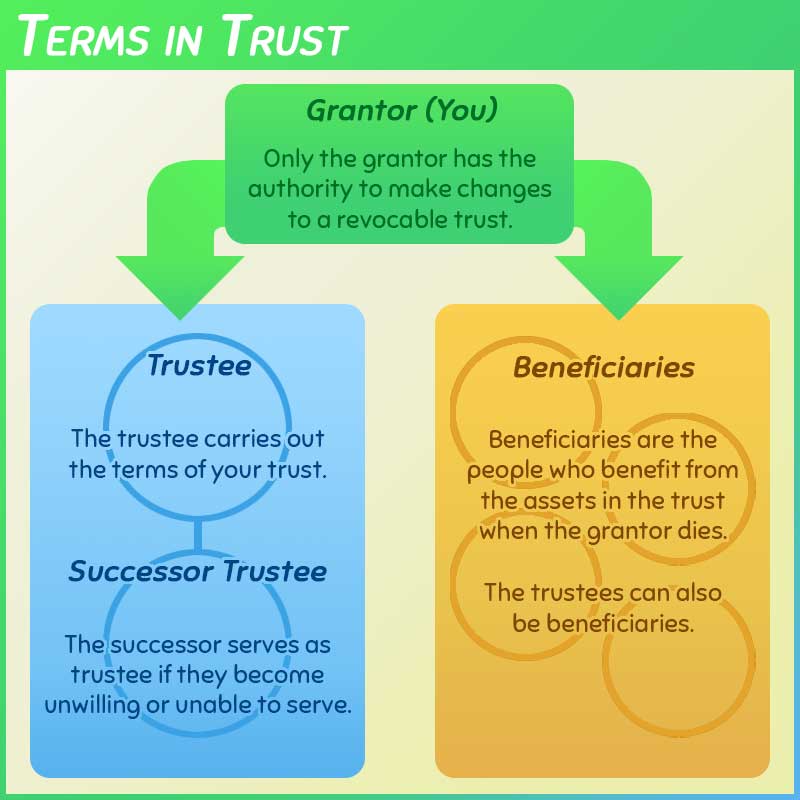

Trustee and beneficiary are particular terms that indicate the role of individuals you choose to handle your affairs, benefit from your affairs, or both.

Consider the root of each word.

“Trustee” has the word “trust” as its base. The person you choose as your trustee is a person whom you trust implicitly to take responsibility for carrying out your wishes and respecting your choices both medically and financially.

A “beneficiary” has “benefit” as its root. This is the person (or persons) who benefits from the proceeds of your estate.

You can name the same person as your trustee and as your beneficiary, though it is also acceptable to have different people serve in these roles. Additionally, while you will have only one trustee, you may have multiple beneficiaries.

Trustee

Your trustee is tasked with carrying out the terms outlined in your trust. It is not uncommon for married couples to name themselves co-trustees. When one person dies, the other can continue to maintain his or her own finances and personal affairs just the same as before, without going through probate.

Successor Trustee

Just as it’s a good idea to have a primary and secondary beneficiary, it’s also a good idea to name a successor trustee. This is a person who has the responsibility to step in and serve as trustee should the original trustee become incapacitated themselves or no longer be able to serve in that role.

Grantor

The person who has the trust (in other words, you) is the grantor. You are granting another person the legal right to step in and manage your affairs should you not be able to do so on your own. If you set up a trust with your spouse, you are both co-grantors. The grantor is the only person with the authority to make changes to the trust, as long as the trust is revocable.

Beneficiary

Beneficiaries are the people who benefit from the assets in the trust once the grantor dies.

Who Benefits From a Living Trust?

You, primarily. The simple peace of mind that stems from having a documented, legal, private plan in place for your assets is invaluable.

As you know all too well as a physician, anything can happen in life and in health. It’s always better to be over-prepared than the alternative.

Revocable living trusts, as the name would imply, can be changed at any time should your circumstances – or your mind – change.

One of the greatest benefits to physicians in setting up a revocable living trust is that it minimizes problems and delays for your heirs after you pass with probate and with the IRS.

Of course, you benefit from a living trust while still alive but not in the way you might prefer. We would all like to be alive and well and able to make decisions for ourselves, but living trusts and other legal estate documents are designed to offer peace of mind.

These documents are also designed to cover the expenses of your family, beneficiaries, and your own medical expenses and care while you are incapacitated. Think about it this way: if you are in a coma and unable to communicate, you have medical bills that begin to rack up. Let’s say your trustee is also your spouse, and he or she has household bills that don’t stop just because you are in the hospital.

If you have a living trust set up, your spouse will be able to draw money from that trust to cover your medical bills, plus his or her own regular expenses. They won’t have to worry about getting power of attorney to make withdrawals from accounts or access any particular funds, because part of the point of having the trust is so that these details are already taken care of.

Assets held in trust may be used to pay expenses such as:

- Child support

- Spousal support, if applicable

- Debts for “necessities of life” such as food or shelter for you, your spouse, other family members, or whomever you designate

What is the Spendthrift Clause?

You have probably heard the stories about the family that has a wealthy parent pass away only for the adult children to inherit the money all at once and squander it away.

Or, perhaps the children are minors, so the money is held in trust until they turn 18 or perhaps 21, and then they receive it in a lump sum. Because they are young and have limited understanding of managing personal finances, they spend it all quickly and wind up in a difficult situation

There is a clause available for any living trust to avoid just such scenarios. This clause is known as the “spendthrift” clause because it is designed to stop your heirs from becoming spendthrifts with your hard-earned money.

A spendthrift clause prevents your heirs from spending all of your – now their – money in one place.

This clause is a provision that also provides peace of mind for you if you wish to leave a considerable sum of money to your heir(s) but do not trust them, due perhaps to age or lack of personal responsibility.

The spendthrift clause, as well as the living trust itself, also protects your heirs against creditors seizing the money to pay off any outstanding debts.

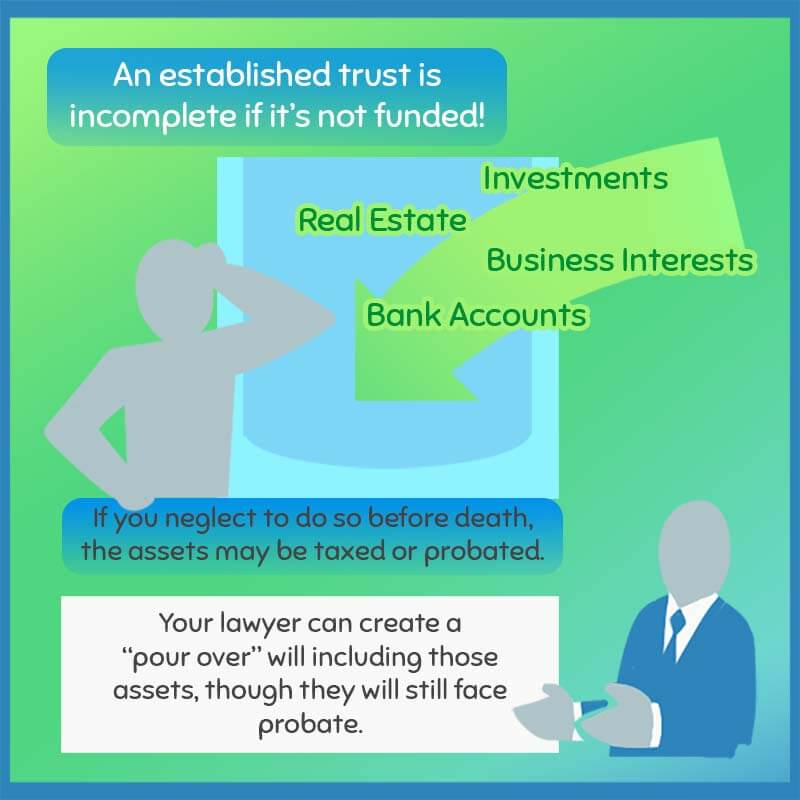

Be Sure to Fund Your Trust

This may sound silly, because why wouldn’t you fund your trust? But establishing the trust is only the first step. You then must decide which assets to place in the trust and take care of the paperwork needed to move them over.

Have you ever heard the expression “trust fund baby?” Or read about someone who receives a set amount of money every month or every year from a trust fund? That money comes from a trust. Someone in that individual’s life set up a trust funded it with their assets, and now the money generated from the trust provides income for one or more heirs.

A revocable living trust can actually stand in place of a will if you wish. Or, it can include your will as part of the document. You have quite a few options for protecting your assets when it comes to estate management.

Should you neglect to place any assets into your trust, at the time of your death, those funds may be taxed and also get hung up through probate, meaning your heirs may have a large bill on their hands as well as possibly not gaining access to the remaining funds for quite some time.

Don’t put off funding your trust. As a physician, you know better than most that accidents can happen in the blink of an eye, and you could be incapacitated without any warning. The whole point of estate planning is to be prepared for any such eventuality. As physicians, you can protect more than your personal affairs with a revocable living trust. They can protect the practice you have carefully built over your career.

As for what physicians should put into their living trust, the answer is: pretty much everything. Your attorney will best advice based on your specific situation, but in general, you should fund your trust with real estate, bank accounts, investments, and of course, business interests. Your business interests are where being a physician is particularly important, should you own your own practice.

If you forget to transfer assets to your trust, do not worry. Your estate planning attorney can create a “pour over” will include those forgotten assets, though those assets will not avoid probate.

Moving Forward

Remember, a living trust is revocable, so adding assets to the trust doesn’t stop them from being assets.

The difference between having an asset in a living trust versus not is the difference of having the paperwork in place to protect your real estate should you die versus knowing that your assets could wind up unprotected, heavily taxed, and in probate.

A living trust is almost always a good idea.