We get it, making updates to your estate planning documents isn’t exactly “fun” or even top of mind for many of us. While looking ahead to the day of our demise can be sobering, planning ahead for our inevitable death will actually help us focus on the here and now.

Writing a will and working with an attorney to craft an estate plan is only step one of the processes. Throughout your life, you should be mindful of reviewing and updating your estate plan with your attorney at logical intervals and checkpoints. This way, you can ensure any changes in your life, and your choices are noted and legalized.

While the following list is by no means exhaustive, here are 12 reasons when and why you should update your estate planning documents.

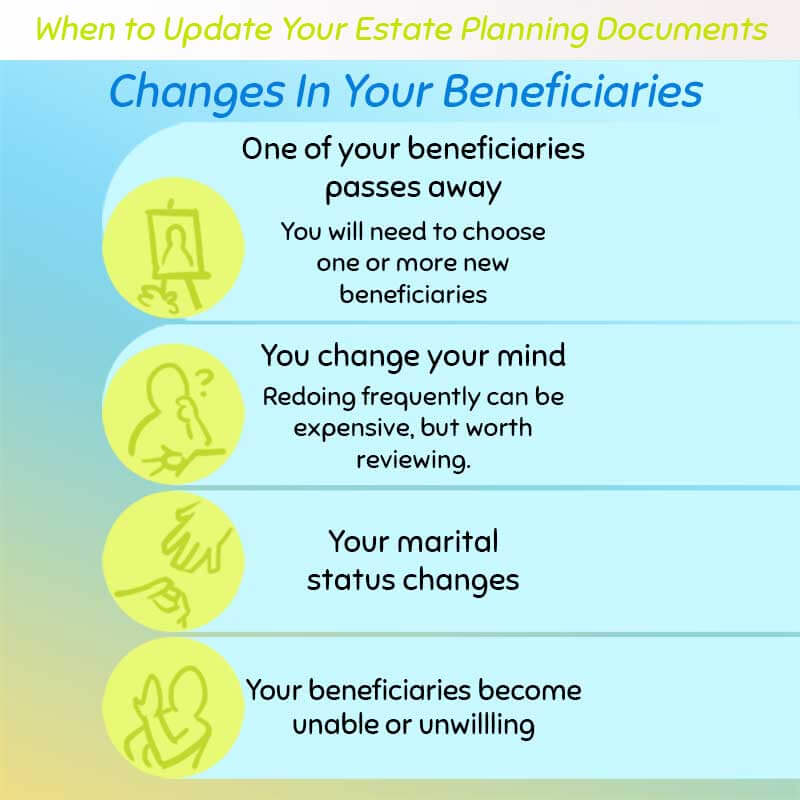

1. Update your estate planning documents when there are changes in your beneficiaries

One of your beneficiaries passes away

This is one of the more obvious reasons that it’s time to revisit your estate plan. If the person or persons you have designated to receive your assets has died, you will need to update your estate planning documents to choose one or more new beneficiaries.

Don’t ever assume that someone who seems obvious to you – such as a spouse or child – will automatically become your new beneficiary. Laws are unique to each state, and the only way to ensure that your personal preferences are adhered to is to put them in writing with a legalized document.

You change your mind

You can change your mind an endless amount of times when it comes to who will receive your assets at the time of your death. While redoing the paperwork on a frequent basis will be expensive, it’s a good idea to review your estate plan and (re)consider your choices anytime you change your mind about a major component of the plan. If you’re sure it’s time to designate someone new as a beneficiary or to remove someone from your will, be sure to get that in writing.

Absolutely update your estate planning documents if your marital status changes

Any time your marital status changes you will need to make changes to your estate planning documents. Marriage or divorce are the most obvious changes, but becoming legally separated or entering into a common-law marriage brings their own legal decisions that will need to be made as well as ensuring that you have the appropriate protections. This is especially important because the law does not necessarily act in the way you might expect when it comes to probate. For example, you may see yourself as a common-law married when the law does not. Make sure your wishes are legalized in writing by updating the correct estate planning documents.

Your beneficiary’s status has changed

Is your beneficiary still willing and able to take on the responsibilities that come with your estate? Has that person become incapacitated in any way? Do they require special care? If so, it’s time to revisit your estate plan with a lawyer and possibly make some new decisions on how to divide up your estate when the time comes.

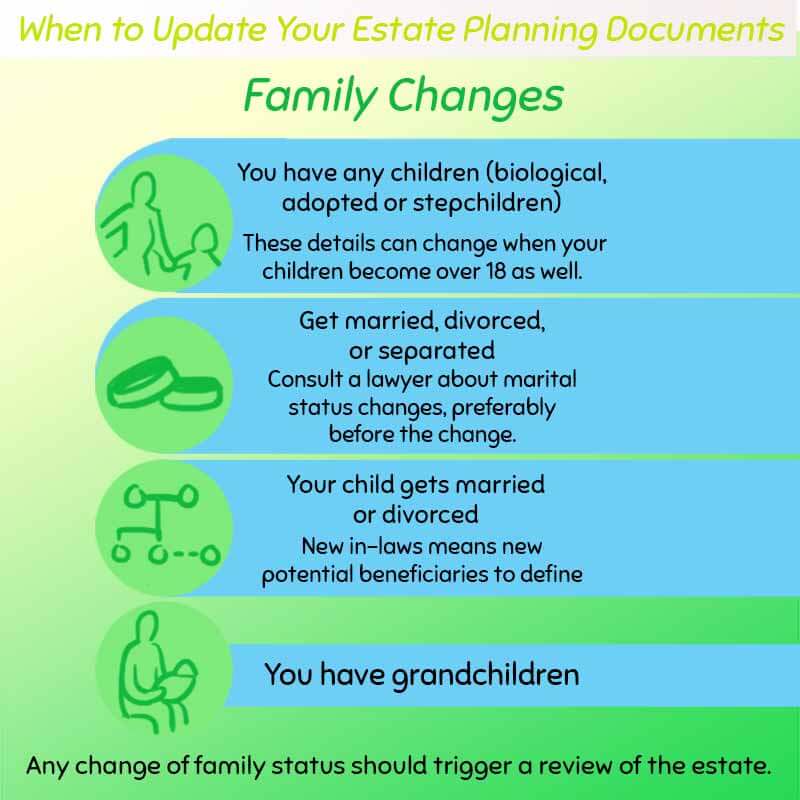

2. Update your estate planning documents when you have any biological or adopted children

You have a child – whether you have a biological child or adopt a child, any time you add a child to your family, it’s time to review your estate plan. This is to ensure that your children are best cared for in the event of your untimely demise and to ensure that your wishes are carried out when it comes time to disburse your assets to your heirs.

You have stepchildren

If you get married and your spouse has children from a previous relationship, you will need to make updates to your estate plan. Any decisions or preferences you have for how your estate will be divided up among heirs, and for identifying who those heirs will be, must be addressed. It is not uncommon for people to marry and wish for personal effects to be bequeathed to their biological/adopted children and not stepchildren so that the items stay in the family bloodline. There are ways that you can honor your stepchildren as well, but that’s exactly why the paperwork is important.

Minor children

Any minor children (children under the age of 18) always require special consideration when it comes to estate planning. They will need guardianship, living expenses, and possibly money for their education to be considered and planned for.

Minor children who come of age

If you planned your estate while your children were minors, and they come of age, it’s time to update your estate plan. The laws about heirs and beneficiaries change when someone becomes an adult.

3. Update your estate plan if you get married, divorced, or separated

Consult a lawyer before the change, if possible

Any change in marital status should trigger an automatic review of your estate plan. If at all possible, schedule this review prior to the change in your marital status. To delay that review until after you are married, divorced, or separated could have important legal ramifications about what you are obligated to leave a spouse or ex-spouse after you die.

Make sure to update if you need to separate your assets from an ex-spouse

If you get divorced or are in the process of getting divorced, you’ll want to do more than just decide who gets the house or the car or all of your bitcoin. Reviewing your retirement assets, your business, and even your debt is crucial to make sure that you each get to keep what is yours.

You may not have to change anything

Depending on your financial situation, you may have to change everything about your estate plan, nothing about your estate plan, or somewhere in between. This is where the right lawyer comes in very handy.

4. Review your documents when you move to another state

Tax laws vary from state to state, and moving can trigger a change in tax status. Any time you move to a new state, you’ll want to schedule a meeting with your estate attorney to see what, if anything, you might need to adjust. Checking in with your accountant is a good idea as well.

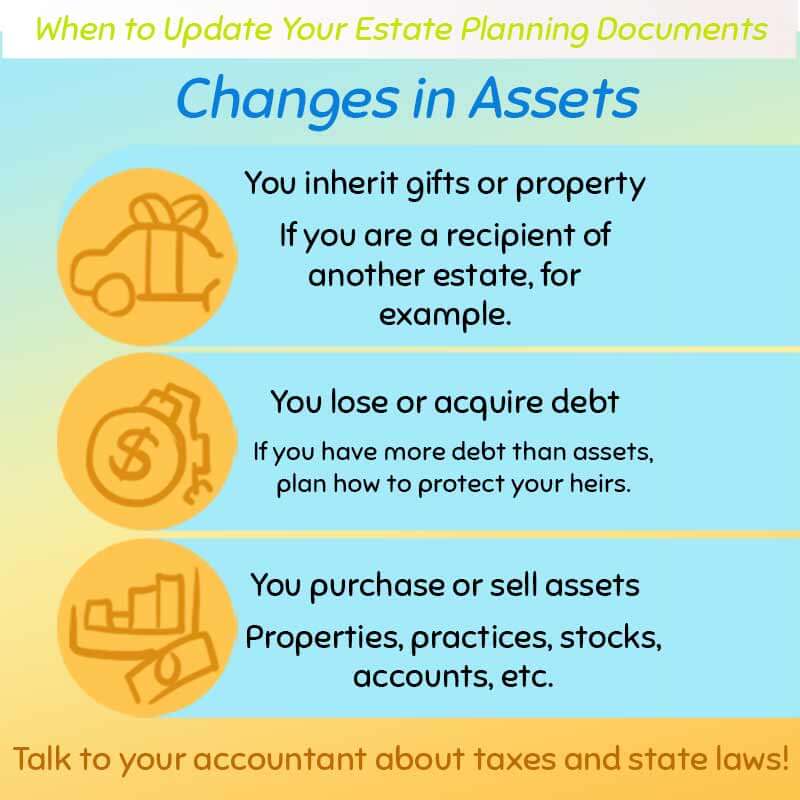

5. Revisit your estate documents if you inherit a substantial gift or property

If you are on the receiving end of someone else’s estate plan, you will want to be sure to include your new asset in your own plan.

Don’t forget the taxes

There are always taxes to be paid and your best bet to minimize the pain from Uncle Sam is to ensure that you consult your estate attorney and accountant sooner rather than later.

Establish a trust

If you don’t already have one, consider establishing a trust to hold assets on behalf of a beneficiary. The trust will enable beneficiaries to access the assets much faster than if you didn’t have a will.

6. Review your estate planning documents if you lose or acquire debt

Determine who pays the bills

Most of us have debt in some form of another. Physicians, in particular, have upwards of six figures of student loan debt that can take decades to pay off. Make sure that your loved ones are able to inherit your assets with as little legal red tape as possible by adjusting your estate plan to account for how certain bills will need to be paid.

If you have an insolvent estate

If you have more debts than assets, first, do not worry or feel bad because you are not alone. Second, this is an excellent opportunity to ensure that you have your lawyer and accountant review your estate plan to minimize the pain that will be passed on to your heirs.

Debt is tricky

The tax rules and other issues surrounding debt at the time of death can be tricky and there are lots of exceptions to every rule. Be sure to have a lawyer on your side to help you navigate how to set up your estate plan to account for your debt in as straightforward way as possible.

7. Update your estate planning documents if your child gets married or divorced

That’s right, estate planning relating to marriage is not just for you. It also applies to any adult children you have should their marital status change. Why? Because they are, presumably, among your beneficiaries, only now there is a spouse who is part of the family, plus any children of that spouse.

You might not be concerned about who argues over what once you are gone, but if you want to make the distribution of your estate as seamless as possible for your beneficiaries, review your estate plan and include provisions for the new relatives.

Grandchildren who might want your stuff

Your children may have children who fight over your assets once you’re gone. This will be particularly tricky if your children pass away as well and your estate plan has not yet been updated.

Any change of life should trigger a review of the estate, whether with your children, their children, your own marriage or divorce, or their marriage or divorce.

8. Review your estate planning documents if you own a business

Have a business succession plan?

Your estate plan should include your succession plan for the business. Even if your business is in debt, as most businesses are at some point, you will need to have the proper legal documents drawn up to designate who will have ownership and control over your business once you are gone.

You will need to specify who will own the business, and who will run the business. Otherwise, your life’s work could fall into the wrong hands.

9. Update your estate plan if you don’t have a living will

If you don’t already have a living will, you should. You’re a doctor. You know that a living will is crucial should you become incapacitated.

If you do have a living will, you also know that reviewing it periodically is important. Things change. You may have different interests and preferences now that some time has passed. It’s a good idea to review your living will about every three to five years.

10. Update if you need to change your power of attorney

If your power of attorney has or needs to change, your estate plan needs to change, too. Make sure your wishes are accurate.

You can revoke the power of attorney and appoint someone new at any time. This should be done as part of your estate plan to ensure proper legality.

You will also want to review both a durable power of attorney, which will remain in place should you become incapacitated, and healthcare power of attorney, which, as you know, allows someone the legal right to make decisions for your medical care specifically should you be unable to do so yourself.

11. Review your estate documents if you purchase or sell assets

Assets change throughout our lives and careers. You might buy and sell a property. Open and close a medical practice. Start a nonprofit. Buy stocks and fund your retirement accounts. As you make these changes to your financial portfolio, there are taxes to be paid.

If you move from one state to another, the rules change. Review your estate plan to see if adding those new assets to a trust will benefit you.

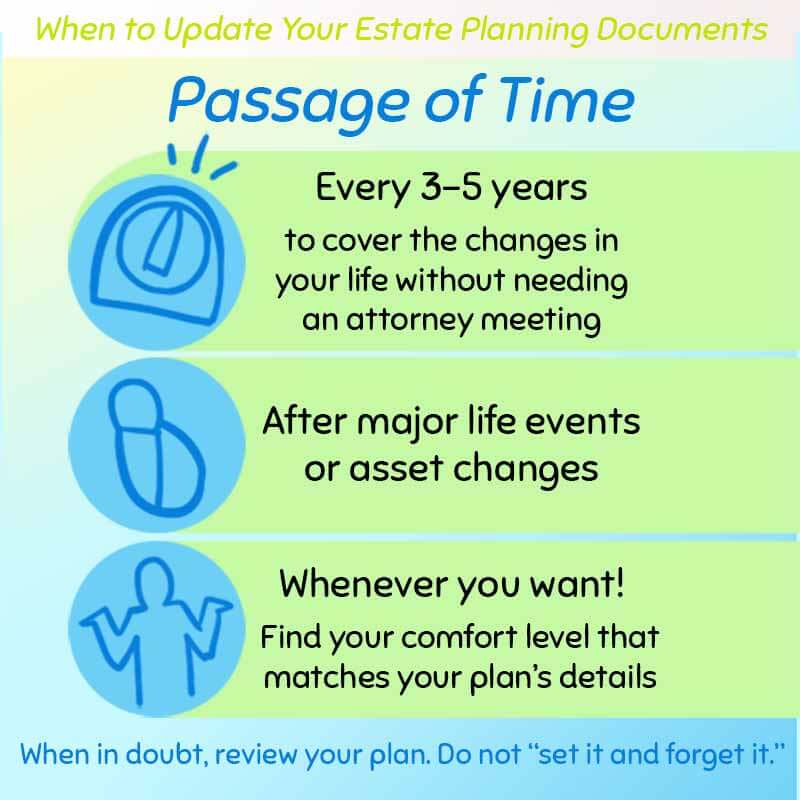

12. An in-depth review is needed if there has been considerable passage of time

One of the biggest and most important reasons to update your estate plan documents is also the simplest: because time has passed. Things change. People change. We change our minds, and we change our preferences. We buy things, we sell things, we acquire things. Don’t let the typical passage of time stop you from making deliberate, intentional decisions about your hard-earned assets.

Review your estate planning documents every year

While it certainly won’t hurt to update your estate plan every year, you don’t necessarily need to do it that often. We don’t advise that you review it any more frequently than once a year because not enough will likely change in your life to make the legal fees and time of an annual review worth it.

Updates to your estate planning documents are likely needed every three to five years

Barring a major life event, we recommend reviewing your estate plan every three to five years, on average. This is enough of a passage of time to likely have some items in need of updating, but not so frequent that you will waste time or money in meeting with your attorney.

Review your estate planning documents any time you experience a major life event

If you or an heir are married, divorced, or legally separated, or if you have a minor child or a minor child who becomes an adult, it’s time to update your estate plan.

Revisit your documents any time you buy or sell a major asset or collection of assets

If you buy or sell property, or a business, or acquire an inheritance of your own, you will want to review your estate plan to ensure that everything is properly accounted for.

Review whenever you want!

You are, of course, welcome and encouraged to meet with your estate attorney whenever you like. If three to five years seems too frequent and you want to only review your estate plan once every ten years, that is perfectly fine.

Find your comfort level and go with that. Seek out your attorney’s advice as well, as he or she may have a recommendation based on the specifics of your plan.

The bottom line

Above all, a few key things to remember are that your comfort level matters, big life changes should trigger a review of your estate plan, and keep good, solid professionals like an estate lawyer or accountant in your corner at all times. When in doubt, review your estate plan. The point of the plan is to give you peace of mind, so whatever you need to do to ensure that it is up to date is what you should do.

Just make sure to remember that estate planning does not fall under the header of “set it and forget it.” Whatever intervals or opportunities you choose as a time to review your estate plan, make sure that you do create a schedule that suits your needs.

Be mindful of major life changes. Don’t be afraid to look ahead at the inevitable. Death comes to us all, and the most empowering thing we can do is to look forward with confidence.